How To Set Up A Chart Of Accounts – Business Tips

Article credit: Sage

In the age of modern software, when the computer can do much of the hard work for you, setting up a chart of accounts is straightforward. However, knowing how a chart of accounts works is still a good thing to learn.

The first thing to know is that a chart of accounts can be physical (using good old paper and ink) or online. Indeed, most small companies opt for online accounts as this lessens the workload and helps to ensure they make fewer mistakes.

There are two key elements that make up your chart of accounts: the sales ledger and the purchase ledger. These are the vital building blocks and without them, you are not going to get very far. When it comes to the accounting system you’ll be using, most small businesses follow what’s known as cash-basis accounting.

A cash-based business will summarise its sales invoices with a sales ledger and summarise purchases with a purchase ledger. This is the simplest way to keep records. You record income when you receive money from a customer and record expenses when you pay them.

This helps you manage cash flow because it only records revenues and expenses when they appear in your account. Bigger businesses tend to practice accrual-basis accounting.

Accounting records

It’s important to note that nowadays, most people refer to the chart of accounts as the accounting records, and that title gives the game away. All businesses need to keep accounting records, which are made of sales invoices, purchase invoices, and bank statements.

Sid Moore is the owner of Moore Accountancy. She says: “Every business needs to keep accounting records. Some people call it ‘chart of accounts’, some people call it ‘cash book’, I call it ‘accounting records’.

“Accounting records record your sales and your expenditure, and there are many ways of doing this. It can be very simple, or it can be quite detailed, depending on the type of business you have and how good your IT literacy is.

“Your accounting records are a combination of your bills invoices and your purchase invoices and your bank statements. And for a very small cash-based business, they will literally have a summary of their sales invoices, their sales ledger, and a summary of their purchases, their purchase ledger.

“These different building blocks create your accounting records, so it’s important to ensure you have records detailing those different elements.”

How to keep records

Your chart of accounts could be a physical book that compares sales on one side and expenses on the other. Or you could set up a simple spreadsheet document on your computer with a tab for sales invoices and a tab for expenditure. Of course, online accounting software simplifies this further by taking the data and automatically collating and comparing invoices with sales.

Sid says: “In terms of types of record keeping and creating the chart of accounting records, you can have something simple like Excel, where you can have a tab showing each thing.

“So you can have a tab showing sales invoices and the money that’s been coming in from that and you can have another tab showing your purchase invoices, the expenditure you’ve incurred, and then you will compare that. And that will be the core accounting records that you keep.

“Some of our smaller businesses stick with manual book and records, a big cathedral book. On one side is all their cash in, i.e. their sales, and on the other, is their cash out, their purchases. This might be done over via the bank, a debit card or paying cash.

“Or you can use online bookkeeping, where a bank feed comes through and you record your invoices and you record your sales and it automatically matches off.”

Other accounting methods

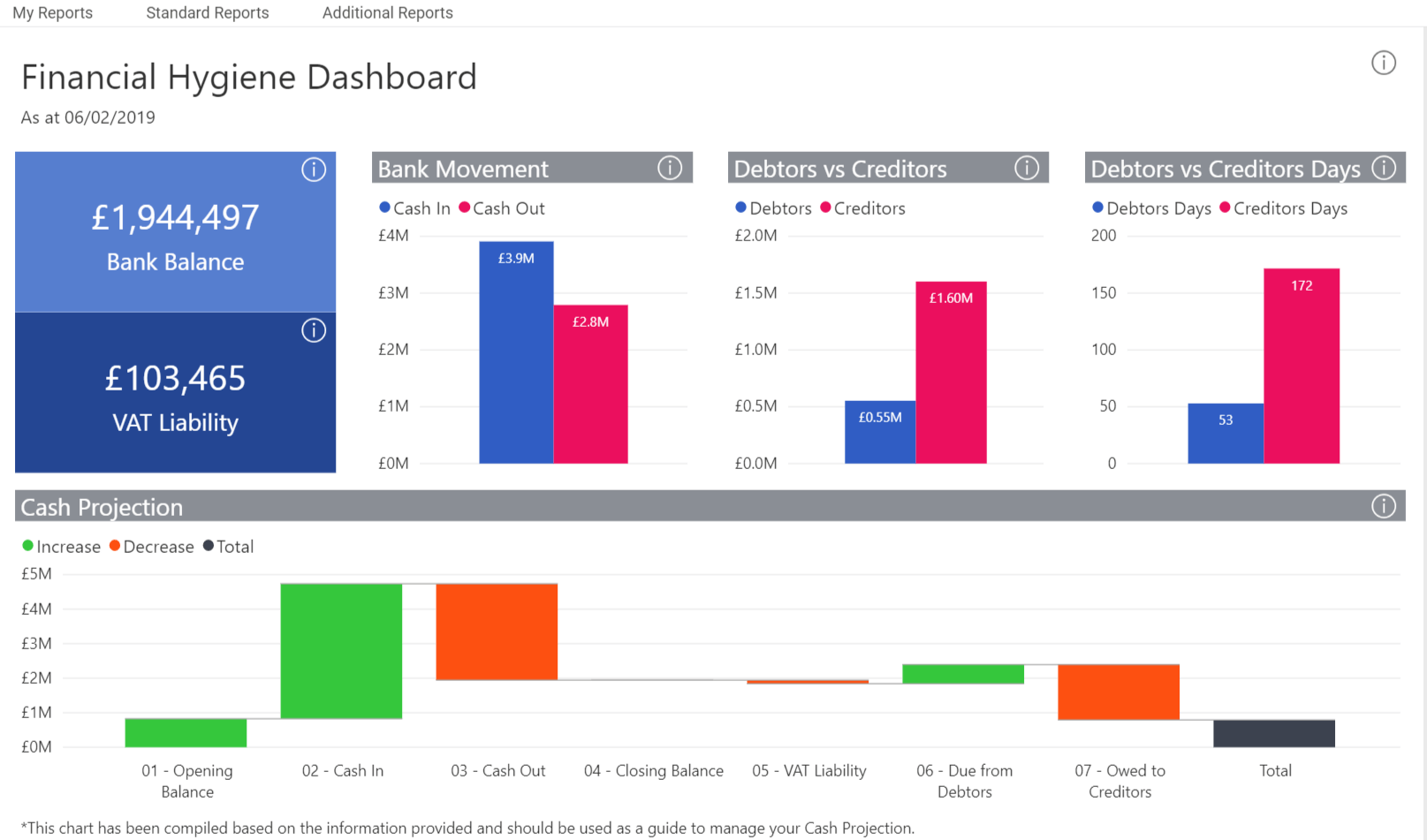

If you run a larger business, your chart of accounts may include debtors and creditors, so it records monies not yet received, or paid. This is called accrual accounting and it records income when the sale is made. The best thing to do is to decide which accounting method you prefer at the outset and use this method both internally and for tax purposes.

Sid says: “A bigger business will have a lot more involved accounting records. They will have what’s called sales ledgers with debtors and purchase ledgers, which have creditors because they may offer credit to people. They may make a sale and say to people they have seven days to pay them, in which they are several different ways to record it, and that’s more detailed.

“As a business, you need to ensure that you keep good records. It’s essential that you understand your sales and expenditure.”

Accounting records top tips

Here are some tips and pointers when it comes to your accounting records:

- You can streamline your chart of accounts using online accounting software

- Ensure your record keeping details sales and purchases

- Small businesses use cash-basis accounting to manage cash flow

- Choose the same method internally and for tax reporting.

Chart of accounts managed digitally

Oliver Squirrell, founder and MD of Pop My Mind, a business that creates unique creative ecosystems for people and businesses, says his company has no physical chart of accounts, as everything is managed digitally via software.

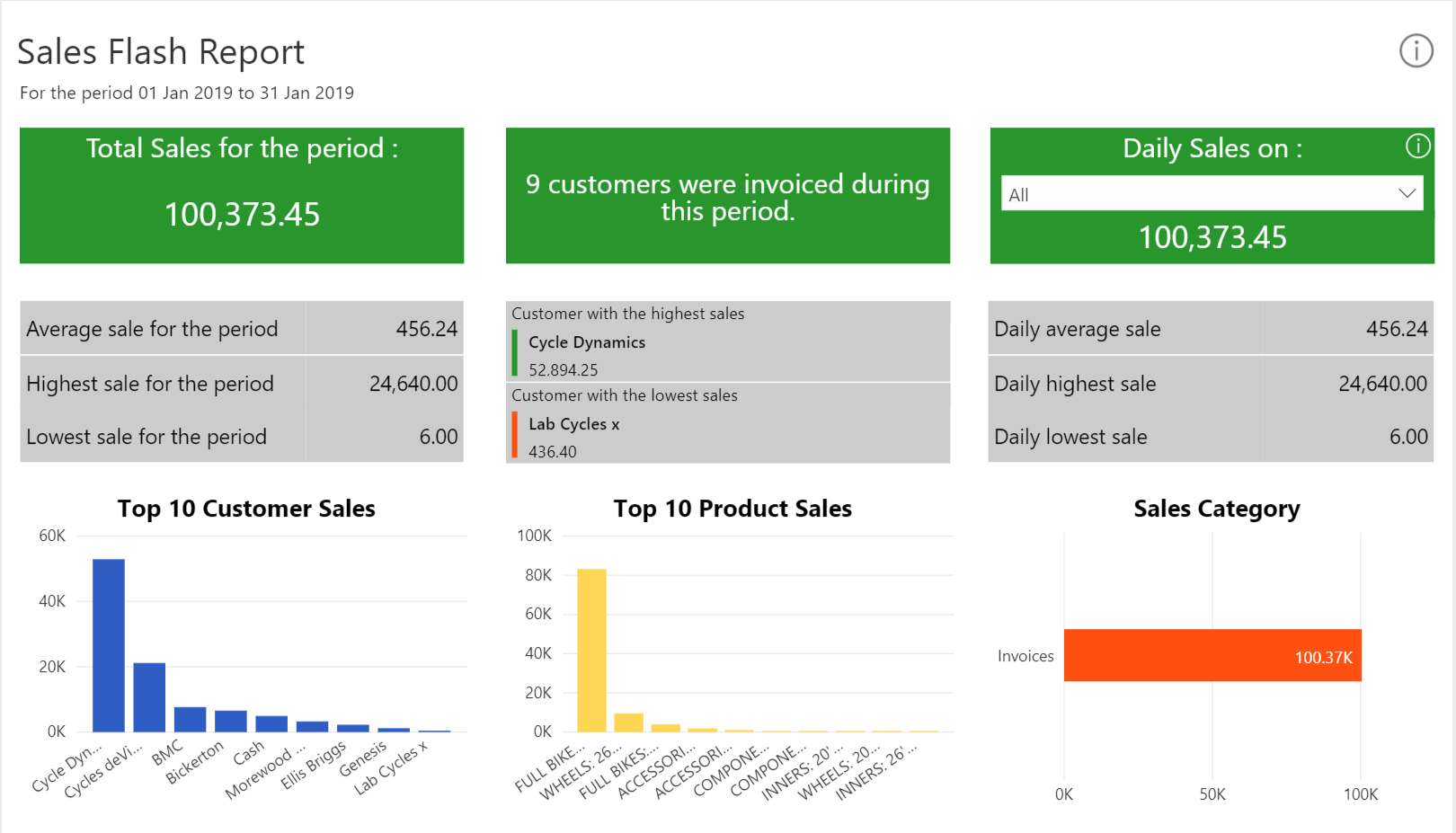

He adds: “Our chart of accounts covers quite a lot of detail, including what’s coming into the business, what’s going out, any direct debits, and bills that we are paying ongoing.

“It breaks down the different types of income that they have as well, which is important to understand, including the balance of where the income is coming from, which all in all gives us a really detailed picture.”

For Oliver, peace of mind that everything tallies up and expectations are meeting reality, is the crucial thing.

How do you manage your records and what sorts of challenges have you overcome? Let us know in the comments below.

Kiteview Technologies (Pty) Ltd was founded in May 2010 to provide the Sage Evolution Business Management solution to the SME market. The management team of Kiteview have combined +30 years of experience in the delivery of small to mid-market Financial & Business Management solutions. This experience, combined with a sound project implementation methodology has helped in Kiteview’s growth, becoming a Platinum status partner for SAGE Pastel within just 1 year.

Contact Us

For An Obligation Free Quote