Simply put, things are changing in a manner that we haven’t experienced since technological breakthroughs like the desktop PC, or the deregulation of the financial markets.

While there are many reasons for this cultural shift, the report found that it is occurring mainly in response to changes that will come to light over the next decade, as the 21st century gets into full swing.

Have you wondered if your practice will be the same in 2030 as it is now, given the technological and societal changes that are happening? How will you prepare?

The evolving profession

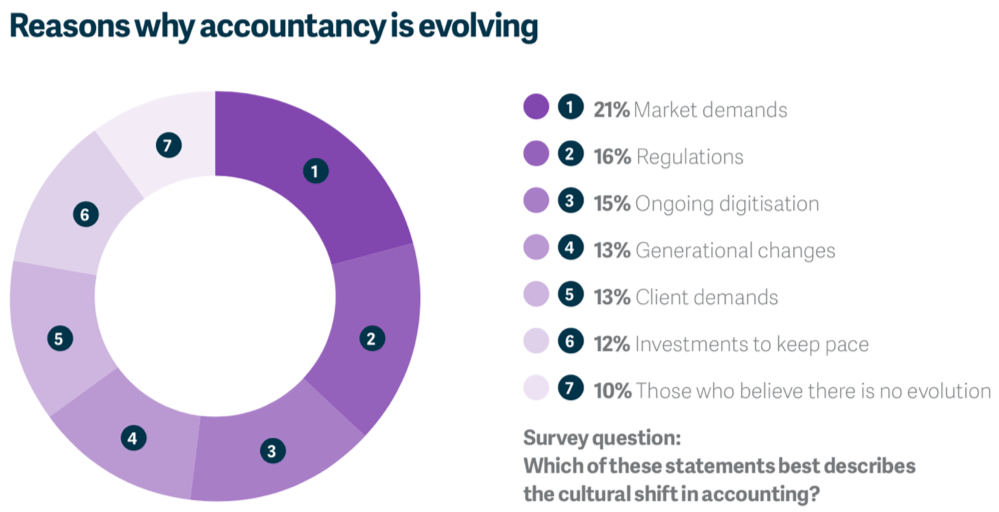

A staggering 90% of accountants agree that there is a cultural shift happening in the industry. Why is this happening? Data suggests that it’s being driven by clients and the marketplace, who together demand more than the traditional number-crunching and compliance work that has, until now, been driving accounting.

This is what the data says:

What are the implications for your practice?

Giving the market what it wants

Market demands are just about anything a client could ask of a practice. This could be simply doing the year-end taxes, but it is increasingly becoming more focused on consultative and partner-oriented advisory services. Note that increasing client demands have become prevalent enough to have their own response and segment in the graph.

Practices are typically founded to cater for market demands. They wouldn’t be very successful if they didn’t.

But how are they to cater for contemporary market demands?

The easiest way to find out is to compare your practice to any new accounting firm in your region. This could be as simple as looking at what services it offers on its marketing material. What is its focus? Is it a specialist? If so, why do you think so?

You will also need to look at the culture. Do they operate mostly via social networking channels? Do they have physical premises or do the staff work remotely? This might seem crazy to some, but it is perfectly normal for others. It allows the practice to save money, which helps it pass on cost-savings to its clients. Many clients appreciate this forward-thinking approach because they could be in the same position themselves.

You could also ask yourself what a practice would look like if it was a start-up today. It is logical that technology would be at the centre of it. In the age of tax and payroll digitisation, you’d be unlikely to set up paper-based processes with clients who still want to bring you boxes of receipts. Would you be anticipating a 100% digital client list?

This is remarkably radical and trying to retrofit it to an existing practice is neither sensible nor desirable. But what bits of wisdom can you glean from this and turn into practical changes in your firm? You might not be able to do much at first, but you could start discussions with your staff about the direction of travel in future.

Regulatory burdens: How to respond

Accountants know the chain of events: Governments implement new legislation, which places strain on businesses. They, in turn, ask their accountants to make sense of it, and often to take care of it.

Has the regulatory situation gotten worse? Recent times have seen numerous financial scandals, forcing worldwide legislature to respond. Ironically, many legislatures in the Western economies have been trying to simultaneously reduce “red tape”. The result has been more of a reshaping of the regulatory landscape, rather than an increase or reduction.

Increasing, or simply differing, regulations remain a core business driver for accountants. It is also a driver of innovation, as different regulations challenge accountants to stay on top of their game. The Practice of Now Report shows that accountants globally agree that this is part of the cultural change.

Your practice has specialisations in regulatory necessities, but is it keeping up with the changes your clients need? Is there training available for you to learn what you need to know? These are questions that the Practice of Now’s findings suggest should not only be asked on a regular basis but should be investigated with the intention that changes are implemented immediately.

Leveraging ongoing digitisation

Accountancy and technology have been bound together for over half a century – the electronic calculator brought the industry into the modern era, and AIand bots are pulling it further into the future by fundamentally changing the way accountants work.

Accountants surveyed in The Practice of Now report do not think that technological adoption is happening fast enough. In fact, 85% believe that the profession in their country needs to increase the rate of adoption in order to remain internationally competitive. Respondents, when asked why firms are lagging, stated lack of time (13%), money (38%), and expertise (25%) were holding them back from digital transformation.

Accountants can be confident that technology is a game changer. Changes throughout generations have shown this time and again. Not adopting new technology would be like taking a step back.

The solution is to simply keep digitisation top of mind. Because technology is evolving at such a rapid rate, adoption cannot happen only once. New and useful products are coming to market on a regular basis.

For example, how good is your knowledge of blockchain and the switch to decentralised ledgers? How is machine learning fundamentally changing the low-level admin jobs within accountancy? If all this sounds like Greek to you, you could have a major problem – and one that will only get worse with time.

Research some technologies and think about how they would affect your current processes and tools. Look at how these technologies are being implemented within businesses. You could even make small investments in training and technologies but be sure to take your clients on the journey with you because, in the end, it’s them who will benefit most.

Adapting to generational changes

Much has been said about Millennials. The US Census Bureau reports that those born between 1983 and 2000 comprise the largest living generation by age. And 2018 marked the first year that people born in the 21st century came of age.

Millennials were born into a world of technology and will incorporate it into all activities without a second thought. According to the Walking the Walk report by Sage, Millennials have a unique set of values that sets them apart from other generations. Over 60% of Millennial entrepreneurs say they have given up profits to stay true to their personal values, and 66% said they prioritise life over work. More than half believe that they will start more than one business in their lifetime.

The reason there is a cultural shift happening is because Millennials are out there creating businesses and impacting the profession. They might need accounting services, but they also know how to take care of the day-to-day processes. What they require most are service-oriented business partners who can guide them through the peaks and troughs of business life. Does your practice provide that? If not, how can you make changes to ensure you stay relevant?

The Millennial generation is not only affecting the client base; they are also entering the profession. There is much to gain by having Millennials on your staff. What better way to draw in Millennial-run businesses to your client base than to have your own staff who they can relate to, and who have the same value set? Be sure to look after your Millennial workforce – research shows that they have little tolerance for low-level work, and high expectations for career advancement.

Evolve and adapt

There are many challenges facing the profession at present. In fact, it might be an unprecedented time of change.

The pressure is on for practices to evolve and adapt. For some, this could mean radical changes. It will most definitely require at least root-and-branch evaluation of you processes – research shows that there is simply no other option if you want to ready your practice for the next decade.

Kiteview Technologies (Pty) Ltd was founded in May 2010 to provide the Sage Evolution Business Management solution to the SME market. The management team of Kiteview have combined +30 years of experience in the delivery of small to mid-market Financial & Business Management solutions. This experience, combined with a sound project implementation methodology has helped in Kiteview’s growth, becoming a Platinum status partner for SAGE Pastel within just 1 year.

Contact Us

For An Obligation Free Quote