How Accountants And Bookkeepers Can Create An Efficient Workflow

Article credit: Sage

Streamlining workflow for your practice will not only make you more efficient and productive, but it will make you more profitable. Managing workflow for your practice is critical. By not taking the time to identify and craft a workflow, you are an heir to your client’s workflow, or even, their prior bookkeeper. (And I’m guessing their prior bookkeeper wasn’t their bookkeeper anymore for good reason.)

The very general flow for bookkeeping or accounting work is data input, data processing, data output. However, there are many differences in each of those key stages. While no two accountants have the same process, there are several key pieces to keep in mind.

Take the necessary time to look at the underlying business process, consider your experience, how you want to accomplish your tasks and look for opportunities to increase your workflow efficiency. Some key questions to ask yourself in order to create an efficient workflow as an accountant or bookkeeper:

What is your method for obtaining records from your clients?

Streamline the way you obtain records from your clients to create efficiencies. Define how you want to obtain data and documents from your clients. There are already so many options even in this first phase of work. Do you want to go paperless? Will you utilize accounting software? Accounting software can automate your workflow, saving time, especially when you use it year-round. The less friction you have between obtaining records, the better.

How are you processing data?

Next is the processing of the data and where your professional expertise can shine through. The bookkeeper or accountant should be the one who keeps up with compliance and tax reform, who determines how transactions should be allocated, and who ensures the workflow is smooth and the financial reporting consistent. It is easy at this stage to fall into the habits of the client or previous bookkeeper by continuing to allocate transactions where they had. The worst reason to do anything a certain way is that that’s the way it’s always been done. I’d much rather do my research for the correct and compliant way, pointing out the risk to myself and the client if not followed, rather than to continue blindly.

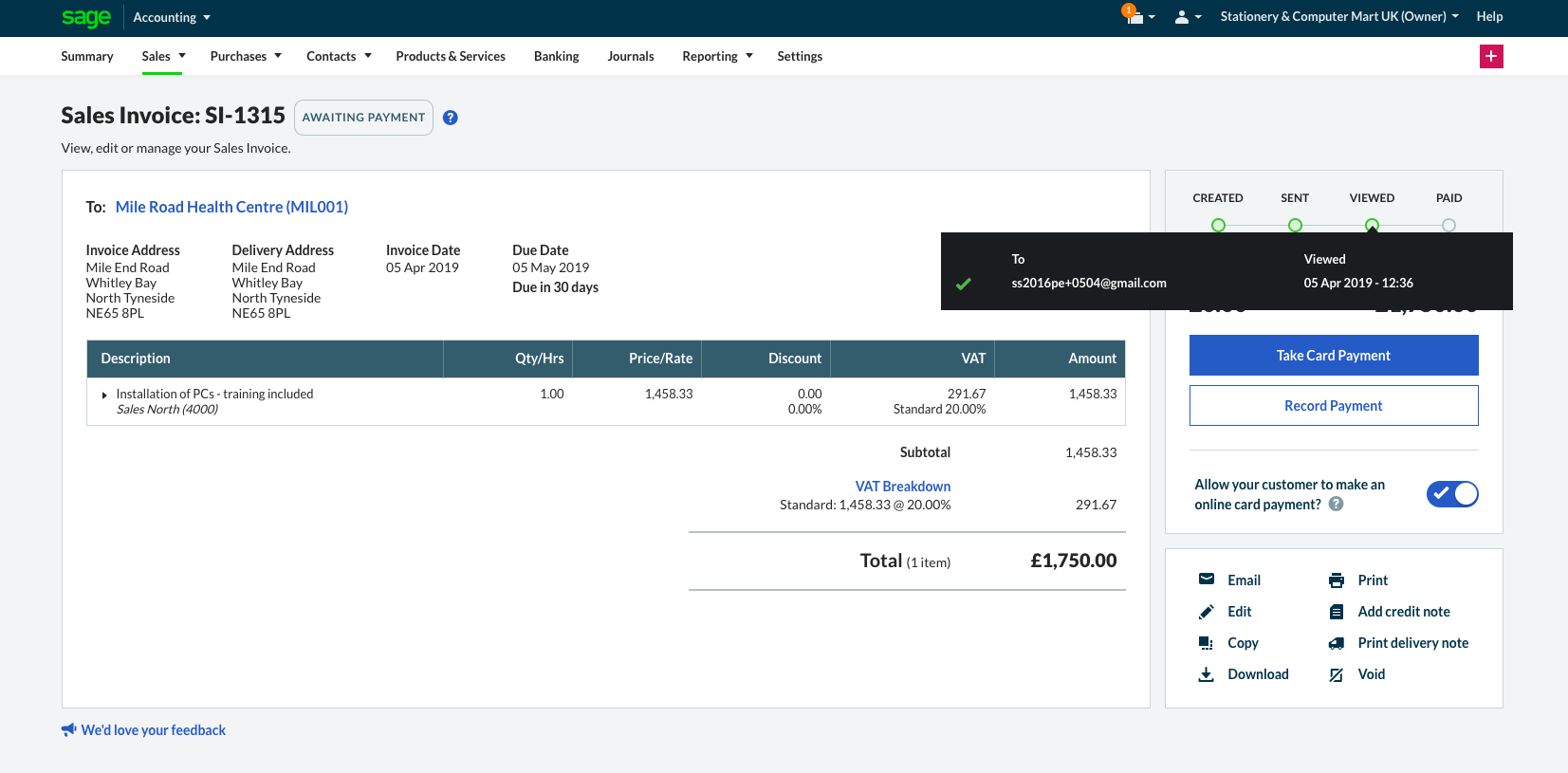

How are you providing output?

Finally, the data output. What have you committed to providing your client? Is it a financial statement package? If so, what financial statements are included and how often is it delivered? Is it a video explaining to them their financial health and how it compares to the previous period? Again, the options are endless for the tools and methods you choose to work. Be sure to set expectations up front with your clients.

Conclusion

It is imperative to take control of your client engagements to succeed as an accountant or bookkeeper. By selecting a common data input method, data processing or workflow, and data output, you will achieve a streamlined and easily replicated system. This repeatable system for your clients will reduce time and energy creating new processes for each client; and therefore, increased profit.

If you haven’t fine-tuned these three vital elements of the bookkeeping or accounting process, it’s not too late. You probably already have tools and workflows you prefer and now it’s about applying the learnings and repeating the system across more of your clients. It may take some time, but between the more predictable workflow and the increased productivity and profitability, I promise it will be worth it.

Kiteview Technologies (Pty) Ltd was founded in May 2010 to provide the Sage Evolution Business Management solution to the SME market. The management team of Kiteview have combined +30 years of experience in the delivery of small to mid-market Financial & Business Management solutions. This experience, combined with a sound project implementation methodology has helped in Kiteview’s growth, becoming a Platinum status partner for SAGE Pastel within just 1 year.

Contact Us

For An Obligation Free Quote