5 Signs Your Company Is Ready For Business Intelligence

Article credit: Sage

Is your company ready for business intelligence? You’ve recently equipped yourself with a nifty accounting solution and finally got on top of all that information that used to lay scattered about in the bottom drawer.

You’re booking in stock, creating neat invoices and you’ve smartly linked your bank account so you can quickly and easily see how much money is coming in, and how much is going out.

There couldn’t possibly be anything else that can make running your business smoother and more efficient, right? Think again. Think business intelligence.

Business intelligence? What are you talking about?

We’re talking about igniting the usefulness of all that data your accounting software is collecting and empowering yourself with accurate information that will help you succeed.

We’re talking about having the confidence to act and make on-the-go decisions about your business based on real facts and figures.

We’re talking about freeing yourself from the burden of never truly knowing where your business is at and how healthy it is at any given moment.

This is the power and effectiveness of business intelligence and why you’ll start winning as soon as you start making use of it. It can be a powerful asset for your company.

How do I know when I’m ready for business intelligence?

The beauty of business intelligence is that no matter how big or small your business is, there’s always a place for it in your arsenal of business success weapons.

Whether you occasionally need a quick glance into the health of your business, a deeper look into the finer details behind the stunning graphs and charts, a means to track and monitor who owes you money and by when, or a more in-depth analysis of your financials over a few months or years – business intelligence has your back.

Here are a few tell-tale signs that you can look out for to be sure you’re ready for business intelligence:

1. You’re not sure whether your business is in the green or red

Unless you monitor your business closely to immediately identify and address what’s causing your profits to shrink, things are likely to get worse.

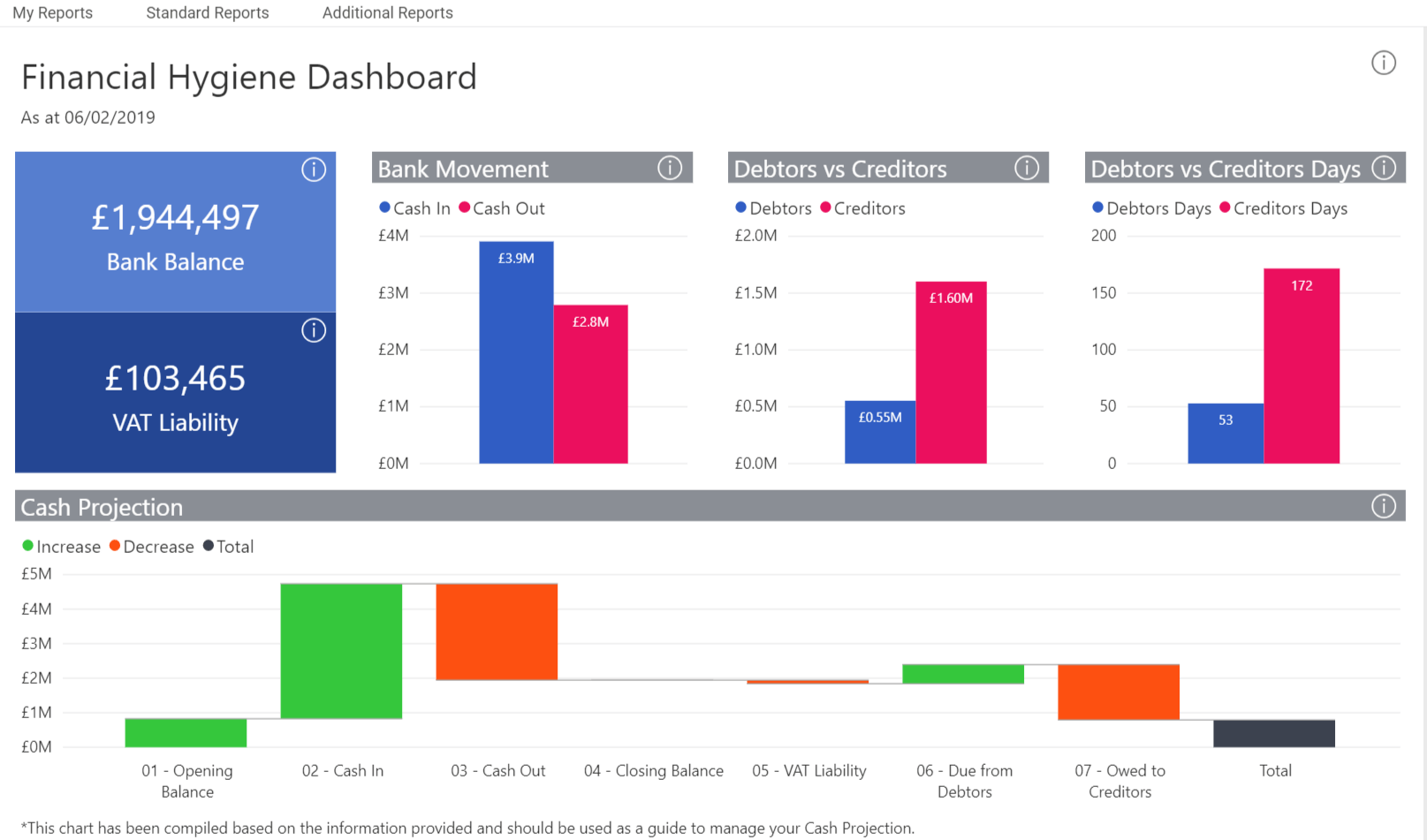

A good dashboard will be able to show you how well your business is performing by monitoring monthly sales trends, managing your expenditures and tracking your profits and profit margins.

By having information such as this at your fingertips, you’re able to determine trends that will impact on future business decisions.

2. You don’t know how much cash you have available to spend

For small business owners, how you manage your cash is especially important because the money you received today may not be enough to run the day-to-day expenses of your business tomorrow.

This is why you need visibility into how much cash is coming in and how much is going out as accurately as possible – and through business intelligence, this information is easily available.

3. You have no idea what your best-selling goods are or who your best customers are

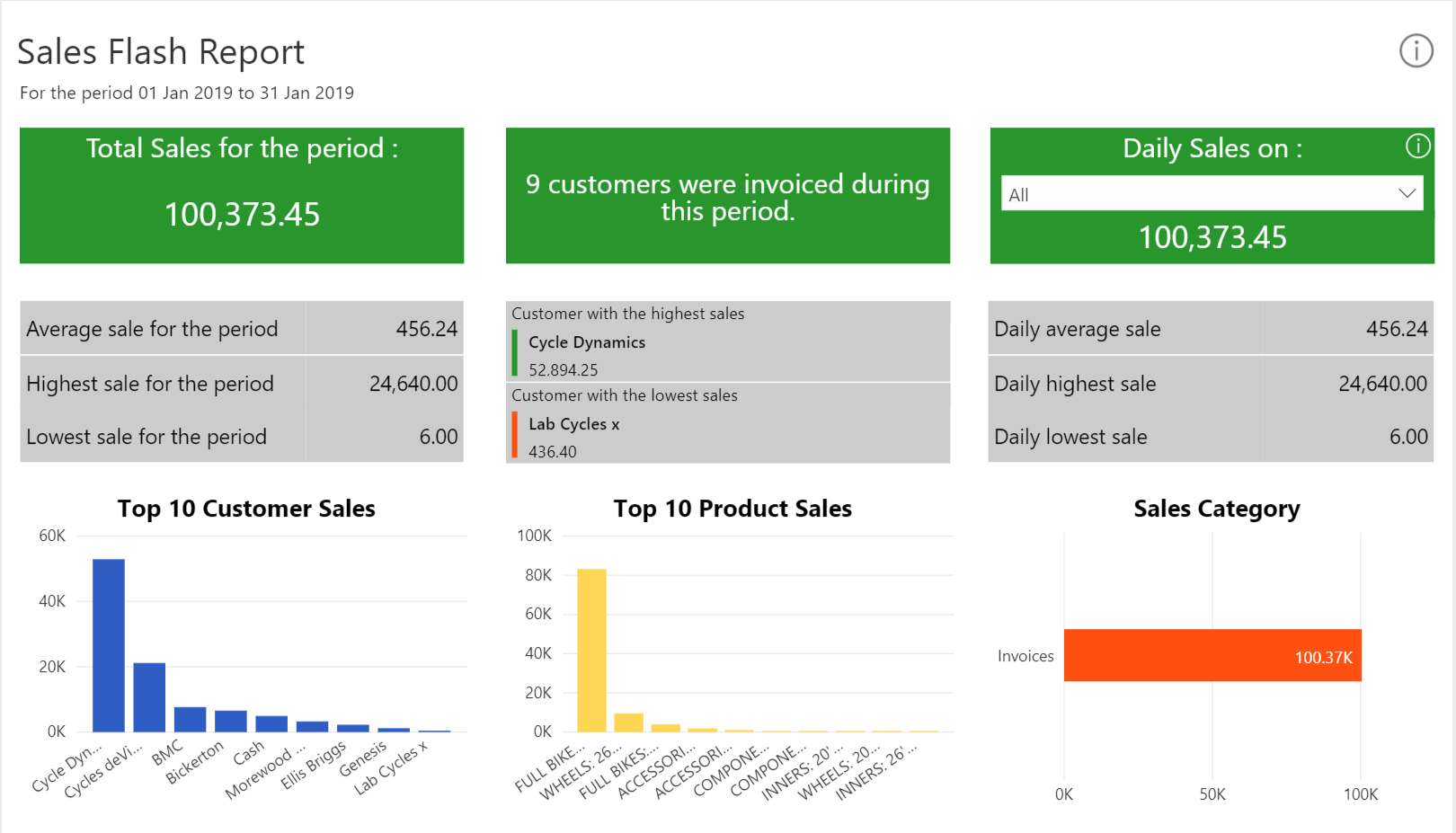

Knowing exactly which of your products or services is selling best and identifying who your top customers are is power for any business owner.

With this information, you’re able to plan ahead when it comes to ordering stock, positioning your products or services and nurturing existing customers.

The more you form relationships with your customers rather than simply managing transactions, the more sustainable your business becomes.

4. You’ve lost track of who owes you money and for how long

It’s important for any business owner to know exactly who owes them cash, how much, and when they can expect to receive it.

Without having visibility into this information, it’s like you’re delicately balancing your company’s cash flow with one hand while walking a tight rope, in the dark.

A good business intelligence solution will not only reveal this information but will also make it possible for you to easily follow up on the overdue amounts before they seriously impact the health of your business.

5. You’re not sure where you spend most of your money and why

As a business owner, you need to know how much money you’re expected to pay your suppliers within your given credit terms in order to optimally maintain your cash flow.

A good dashboard will help you to fully manage your suppliers, which will ensure you maintain strong relationships with your creditors (the person or company who you owe money to).

As you actively communicate and keep up with payments, you’re better positioned to negotiate more advantageous terms that will help your business in the long run.

If any of these statements ring true for you and your business, you’re ready to start using business intelligence and benefiting from the value it adds.

Every day delayed is another day you could have taken advantage of all that data at your fingertips transforming it into actionable business insights that will help take your business further.

You’ve got me – what now?

Convinced it’s high time your data starts working for you? Good.

Now, it’s often thought that implementing a business intelligence solution is complex and costly. Some business owners think that massive costs and IT resources are required to gather the information.

Then, once information has been gathered, they believe time needs to be spent organising the data so it can be used.

While this may have been the case a few years ago, it couldn’t be further from the truth now.

A decent accounting solution already includes standard business intelligence that helps you get an instant view of the data your business gathers.

However, a great accounting solution comes equipped with business intelligence that helps you solve the aforementioned problems and more.

Explore your accounting solution today and ask yourself the following questions when it comes to business intelligence:

1. Is all the information I need to monitor my business ready to use and easily available?

You’re a business owner, not an accountant. We understand you have little time to figure out how to create reports. You need to focus on running your business.

So, the ideal accounting software needs to provide you with dashboards and reports that are ready to use, easy to consume and highlights vital information that impacts your business.

2. Am I able to take a deeper look into this information if something needs investigating?

Gorgeous and visually striking dashboards are great but they sometimes lack in their ability to provide real, action-oriented value.

What if you need to look a little deeper into the information that makes up these flashy graphs and charts?

This is where interactive dashboards come in handy – and we’re not talking about simply reorganising your view of it.

Make sure your accounting solution is equipped with business intelligence that allows you to easily click through and view the details behind the dashboard so you have full visibility into what’s going on in your business.

3. Can I easily customise or create new reports from scratch?

For your business to succeed, your reports must focus on information that is relevant to you and can help you make smart business decisions.

For example, you should have the ability to easily customise your sales reports to show which products are selling fast, as well as products that are not doing as great.

You should also be able to make small tweaks, such as adding extra rows or columns and adding your company logo.

And when you get more comfortable, you’ll also want to be able to easily create your own reports from scratch – depending on your requirements.

Whatever the case, the need for business intelligence regardless or whether you’re just starting out or you’ve starting growing is becoming more and more evident by the day.

Instead of waiting for the tidal wave of data to come tumbling down on top of you, heed the warning signs and ensure you’re proactive in raising your business way above the high-water line.

Kiteview Technologies (Pty) Ltd was founded in May 2010 to provide the Sage Evolution Business Management solution to the SME market. The management team of Kiteview have combined +30 years of experience in the delivery of small to mid-market Financial & Business Management solutions. This experience, combined with a sound project implementation methodology has helped in Kiteview’s growth, becoming a Platinum status partner for SAGE Pastel within just 1 year.

Contact Us

For An Obligation Free Quote