This can make it feel overwhelming to get started. What’s step one when it comes to basic business accounting? What documentation do you need? What should you be monitoring and what signs should you look for to check you’re doing it right? And while there’s plenty of advice available online, how will you find time to sift through it all?

As an advocate for small businesses everywhere, we want to make managing your money as easy as possible so you can focus on making your business a success. So, we created this complete guide to money management and basic business accounting to help you start or grow your small business.

Ready? Let’s get started.

1. Choose a business type and register it

If you don’t already run a business and are just starting out, you’ll need to decide what type of business is the best for you. This is important to decide early in the process as it impacts your business’s structure and many other factors going forward.

The right business structure for you depends on the level of liability you are willing to accept as part of your role in the business. There are several options, each having its own set of advantages and drawbacks as it relates to tax, funding options, administrative procedures and flexibility of operations.

Sole traders

It’s simpler to set up as a sole trader, but you’re personally responsible for your business’s debts. You simply need to register as self-employed with HMRC, and take out any necessary forms of business insurance. We’ll get into more detail about that later. It’s worth bearing in mind, however, that your business name is not protected as a sole trader.

As a sole trader, you also have some accounting responsibilities. You take out ‘drawings’ from your business which are taxed as income. In general, the income level of a sole trader will be comparatively lower than that of a company director, who can extract money via dividend payments at a lower rate of tax.

Company director and limited companies

Setting up a limited company is a little more complex. You need to choose a company name, which is registered at Companies House along with your incorporation paperwork. The name is placed on the Register of Companies, and protected from use by other businesses. You receive a certificate of incorporation specifying the date of incorporation, and including your unique company number.

Company directors are also often employees of their company, and as such, take a salary. A proportion of your remuneration as a director will also be made up of dividend payments which do not attract as much tax. Therefore, it can be more lucrative to be a company director than operate as a sole trader, but with that comes specific legal duties and responsibility.

Limited companies pay corporation tax on profits over a certain level, and benefit from a range of tax reliefs, allowances, and tax deductible expenses. Corporate tax affairs are more complex, and many company directors choose to hire an accountant to ensure their legal obligations are met.

Partnerships

A partnership is the simplest way for two or more people to run a business together. You share responsibility for your business’s debts. You also have accounting responsibilities.

If you’re a partner or partnership:

It’s your responsibility to register your partnership if you’re the nominated partner, or the chosen one to handle the team’s tax requirements. There are different ways to register:

- Limited liability partnership: You can set up (‘incorporate’) a limited liability partnership (LLP) to run a business with 2 or more members. A member can be a person or a company, known as a ‘corporate member’. Each member pays tax on their share of the profits, as in an ‘ordinary’ business partnership, but isn’t personally liable for any debts the business can’t pay. You’ll need to:

- Choose a name

- Have a registered address – this will be publicly available

- Have at least two ‘designated members’

- Have an LLP agreement that says how the LLP will be run

- Register the LLP with Companies House

- For partners who aren’t individuals, like companies: This means the company is legally separate from the people who run it, has separate finances from your personal ones and can keep any profits it makes after paying tax. To set up a private limited company, you need to register with the Companies House. This is called incorporation. You’ll need:

- A company name

- An address for the company

- At least one director

- Details of the company’s shares – you need at least one shareholder

- Your SIC code – this identifies what your company does

2. Set up a business bank account

The next step is to open a company bank account. As a sole trader, you could use your personal account, but having a separate business bank account can help you distinguish between personal and business income and expenditure. Contact your bank for information about account charges and services, but shop around for the best deals.

You’ll also want to think about how you want to get paid. Though many people still carry cash, you’ll want to also offer payment options that are convenient for your customers. After all, the easier it is for them to pay you, the more likely you’ll get paid on time.

Our 2017 Payments Landscape Report shows that while cash is still the most popular payment method, 86% of UK shoppers say they regularly carry a debit card, and 57% carry a credit card. To accept non-cash payments, you’ll need to choose a payment processor. If you want to sell online, you’ll need to select a payment gateway service. Both service providers (which could be one and the same) facilitate your payments from your customers’ bank accounts to yours.

3. Manage your cash flow

Making sure more money comes in than goes out each month can be baffling for new businesses owners. The good news is there are solutions to make life easier, such as outsourcing some of the burden to an accountant or using cloud-based accounting software.

Don’t totally check out from these responsibilities. Instead, grasp the basics of cash flow and stay engaged with how your money moves each month. This will help you stay keen on:

- Managing your accounts

- Drumming up more business

- Chasing payments

What is cash flow?

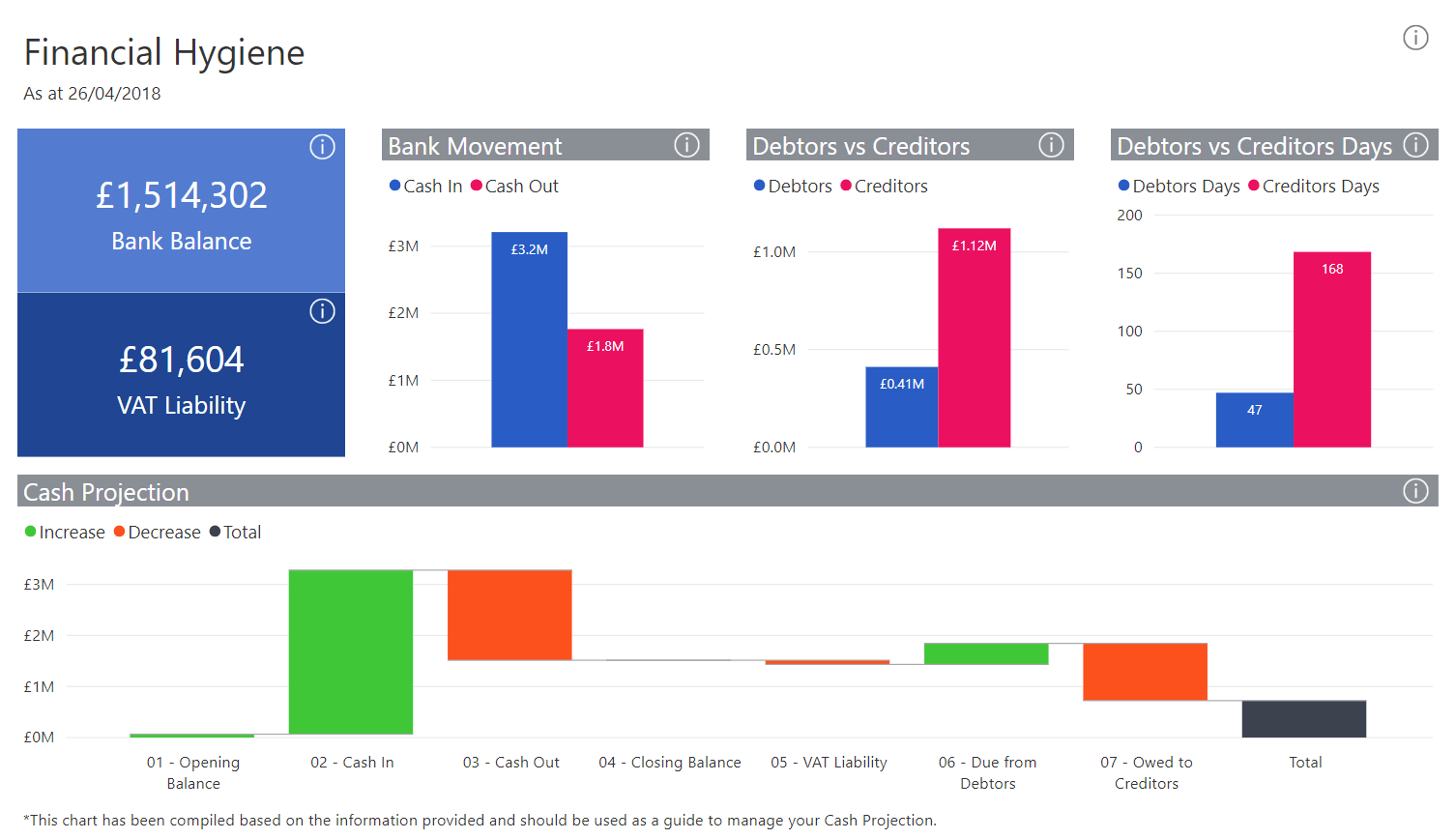

Simply put, businesses fail in the long term when they don’t make a profit. In the short term, they fail because they don’t have enough cash to pay their bills. Cash flow is the life supply of any business – more small businesses fail because of cash flow problems than anything else.

The principles of good cash flow management are straightforward, but it’s also where many businesses struggle. Taking the right steps in the beginning will shape your business’s future. First, you need to make sure you have more money coming in than going out. Money also needs to come in on time, so you can pay suppliers and invest in stock and supplies.

Having access to cash also gives you better buying and negotiating power, which could save you money long-term. Anticipating any shortfalls in funds is important, too. This allows you to make contingency cash flow plans such as extending credit.

Here are 10 tips to keep cash flowing:

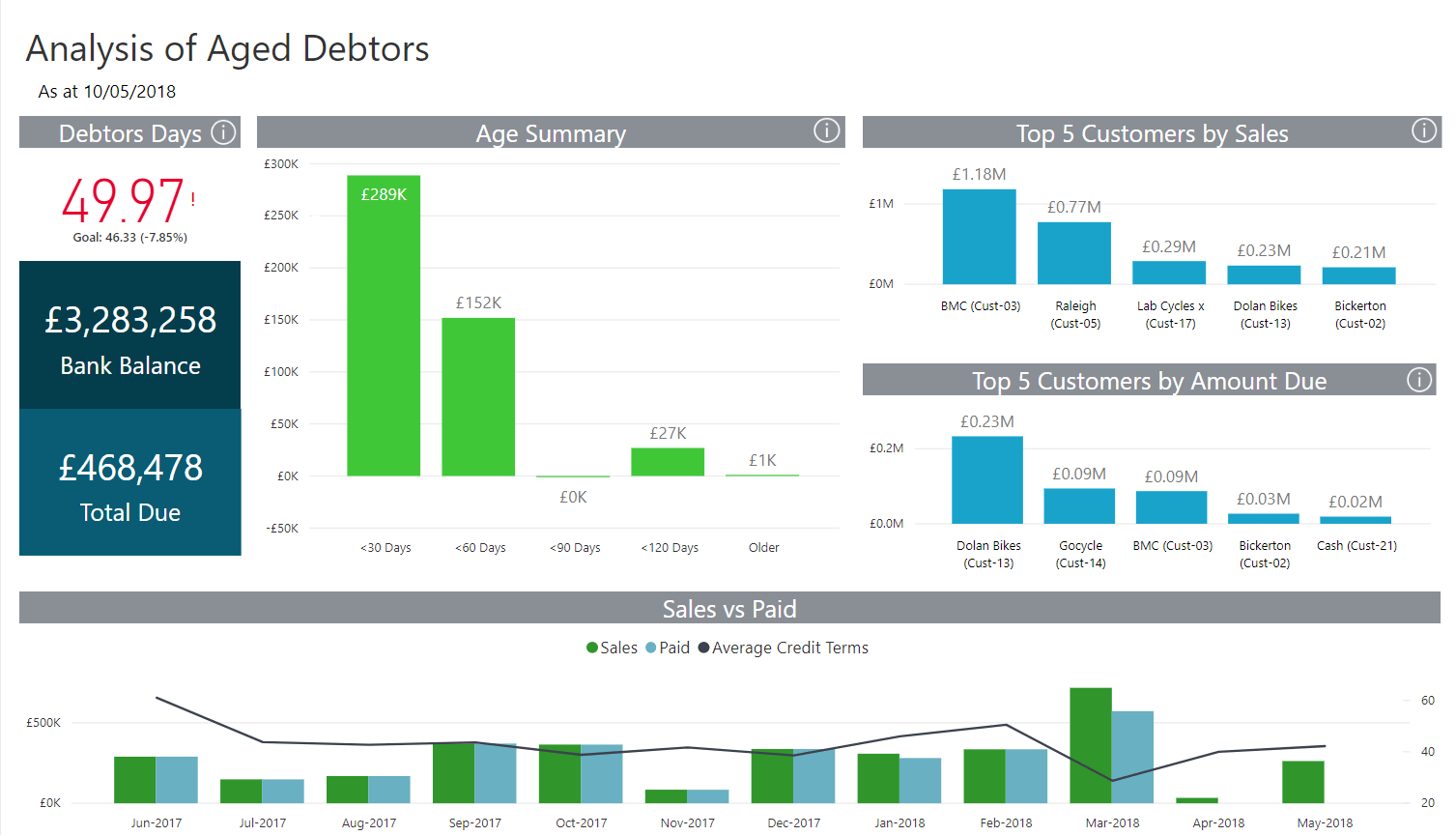

1. Credit control

Setting up a good credit control system doesn’t need to be complicated. It’s about getting paid as soon as possible and setting the processes to help. The basics include setting clear credit limits and payment terms for your customers, sending out invoices promptly and firmly chasing all debts as they are due. Staying on top of customer payments helps you identify which customers you could extend credit to.

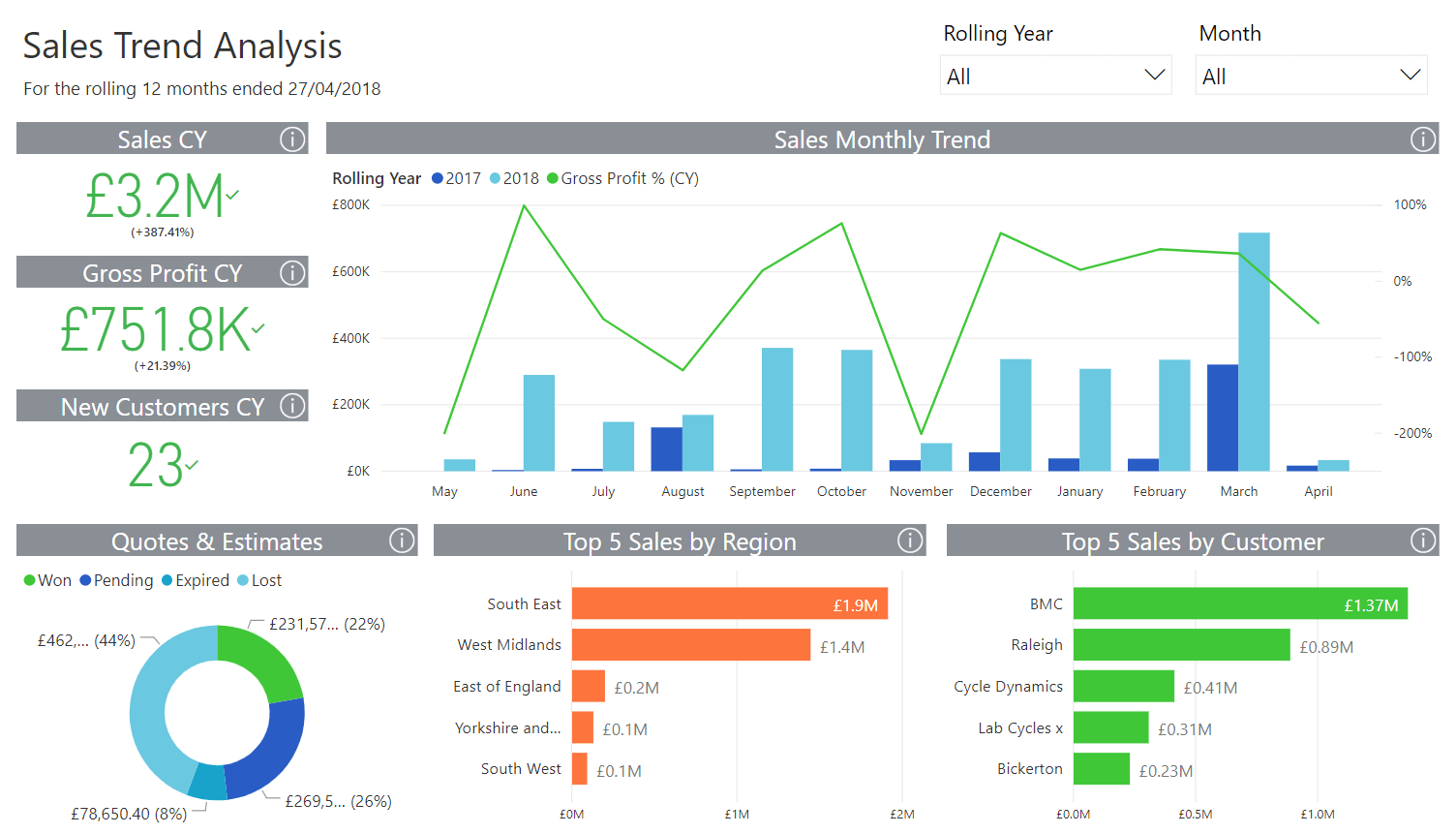

2. Sales forecasting

Sales forecasting is all about predicting what’s ahead to prepare for cash flow peaks and valleys. You can start forecasting cash flow once you have a month’s sales behind you. Using your market knowledge, think about your pricing, your competitors’ pricing, the state of the economy and so on to figure out demand.

Remember: It’s better to be overly cautious than optimistic. This is the best way to avoid nasty surprises.

3. Cutting unnecessary costs and spend

When it comes to preserving cash flow, think lean and mean. Scrutinise every item you buy. Know exactly where your cash is going and always get the best value for your money. Only make purchases that are essential to grow or maintain your business.

Some costs will be tax-deductible for you as a self-employed person. The UK government website has a detailed explanation of qualifying purchases and how to document them. There are a different set of rules for limited companies, so be sure to do your due diligence.

4. Negotiating good terms with suppliers

It’s always worth investigating your payment terms with suppliers. After all, if you can settle your bill in 60 or 90 days rather than 30, you get to keep your cash a while longer and regulate cash flow. If you’re considering making a large order, always negotiate. Find ways to set up a regular payment plan, for example, instead of paying off outstanding amounts in one payment.

5. Managing stock

Monitoring stock closely and only ordering what you need is essential to avoid tying up cash unnecessarily. Work out what sells quickly and profitably to keep income steady. Don’t tie up funds in slow-moving items that are hard to sell. If you need a quick cash injection, try selling off old or outdated stock at a cheaper price.

6. Don’t tie up cash

Once you start making sales regularly, it’s tempting to buy the latest equipment. Think wisely before splurging on excessive purchases and hold on to liquid cash. Ask your supplier for financing options for assets like computers.

7. Keep on good terms with lenders

Times may get tight. Though it can be difficult to get a loan in today’s climate, it pays to keep on the right side of the bank anyway. Always keep your books up-to-date so you can show your figures in case you ever need to borrow. If you’re struggling with repayments, talk to your lender. Don’t bury your head in the sand.

8. Consider alternative finance

Alternative finance providers create a platform for independent investors and small businesses to connect. Small business owners who can’t get funding through high-street bank loans, or want fast, flexible access to capital, can quickly connect with lenders and investors to create their own funding terms.

9. Spotting the warning signs

A slump in turnover, late customer payments, and settling supplier invoices late are telltale signs that your cash flow is suffering. Don’t ignore the warnings. It’s generally easier to work out ways to increase working capital before you incur more debt.

10. Being realistic about your business

Sometimes you need to take a step back to see things clearly. If you are always struggling with cash flow and your cash flow statement is poor, ask yourself ‘why?’. Are your sales too low? Is your pricing off? Can you chase payments more aggressively? Be level-headed about your venture and its future. If you’re not making a profit, you may need to rethink things.

A free guide to managing your cash flow

Our guide is packed with expert advice to help you stay on top of your cash flow.

Get your free guide

4. Stay on top of late payments

Late payments are one of the top reasons businesses struggle with cash flow. The top 5 reasons for late payments are:

- Suppliers changing terms and conditions

- Customers withholding funds to check quality of work

- Customers demanding a payment discount not agreed at the outset

- Suppliers withdrawing credit without notice

- Customers withholding payment to question quality of work or deliver times

Wondering how best to approach that late paying client? Mike Guttridge, business psychologist and member of the British Psychological Society gives his best tips on getting paid.

- When you’re chasing an unpaid bill, you must clearly state what you want to happen. Make sure the client understands your point of view. Explain that you invoiced 30 days ago, the amount is now overdue and you expect to get paid by the end of the week.

- Be nice. Stay calm, but don’t be a pushover. Certain clients will push you to the back of the queue if they think you’ll accept it. Be clear on your goal.

- Keep reiterating the facts. State when you invoiced the customer and your payment terms. Always get the facts right. If you sketch over the details – or worse, get them wrong – you’ll lose credibility and make yourself easier to ignore.

- Make personal contact with the person who hired you. It’s much harder to brush off someone you’ve worked with or built a rapport with in the past. Ask if they can pull strings with the finance department or have a word with the boss.

- Be persistent. Make regular phone calls. Suggest a meeting. Get in touch often.

- If you should deal with the accounts department, be personable. Find out the person’s name and try to understand their point of view. Do they pay only on certain days? Is the company struggling? Treat everyone with respect, including the most junior assistant. It helps.

5. Income and expenditure – what to track and how

At a high level, your financials are the important reports or statements that offer you insights into the fiscal health of your business. It’s important to know what these are and how they are generated so that you’re aware of how your business is performing at any given time.

By law, sole traders must maintain accurate financial records (bookkeeping) and you must retain yearly records for six years if you are running a limited company. It’s key to get organised with how you do this. Many business owners start off with a simple process using spreadsheets, while a growing number opt to use accounting software.

Manual bookkeeping

You can manage your cash flow on spreadsheets, like the kind you can create in Excel. If you’re not an Excel guru, see our Excel Financial Templates eBook for a quick start.

Electronic bookkeeping

Using accounting software to manage your bookkeeping saves time, money and human error. Inexpensive software is available to automate record keeping. For example, it can automatically pull transaction records from your bank account so you don’t have to manually enter each transaction.

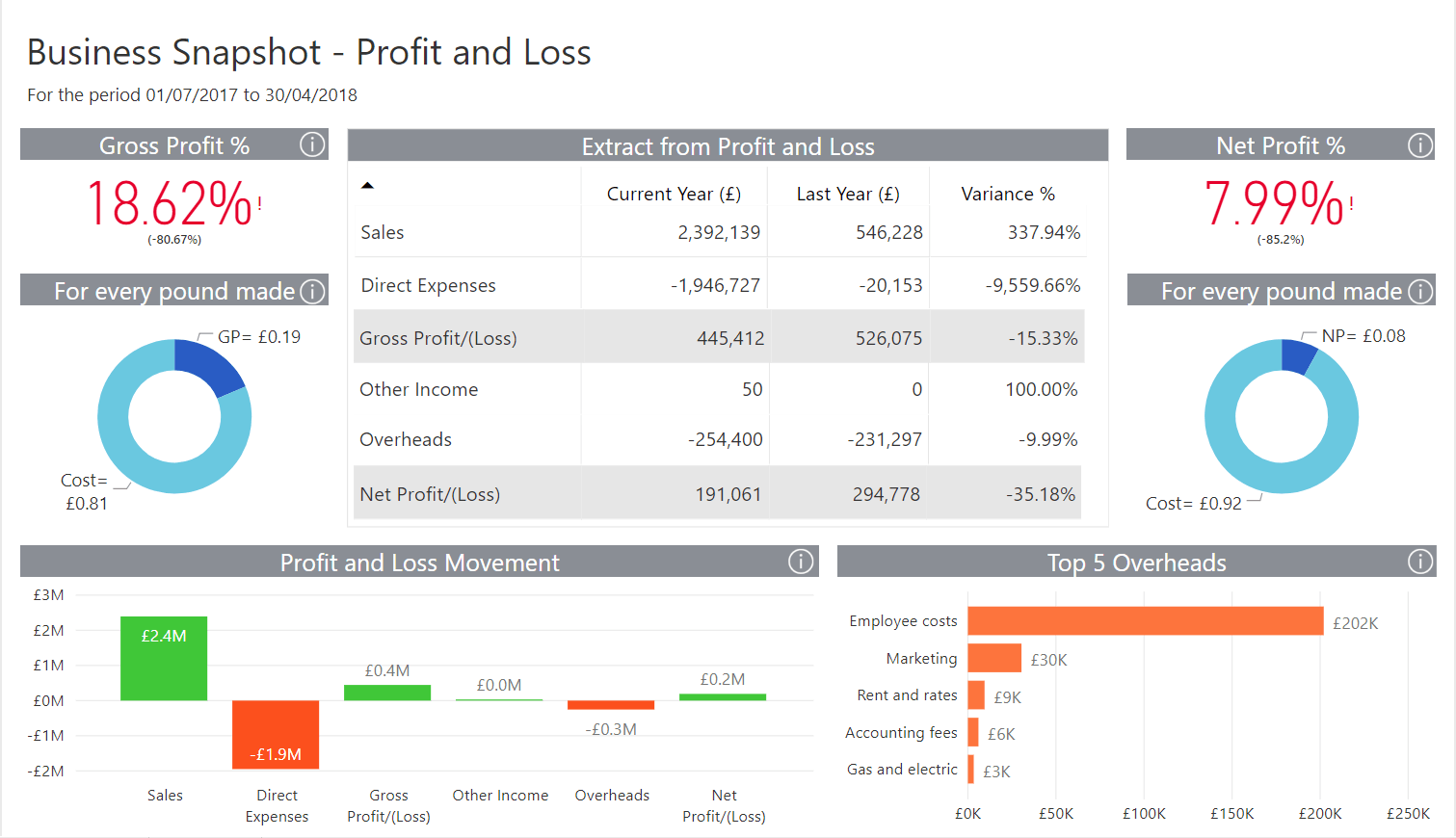

A good business reporting solution can take care of all your vital business information and present it in an at-a-glance view to help you make the right decisions. You can customise your reporting depending on your priorities at any given time. You may want a quick daily overview, drilling down to whatever is appropriate that day.

Tracking your income and expenses in real-time is a big time-saver. If you have a smartphone, there are plenty of free apps available for easily recording income and expenses while on the go. The best apps have features that make keeping up with the details easy, like saving photos of receipts so that you don’t have to keep paper copies.

The three most important financial statements are the balance sheet, the income statement and the cash flow statement.

Balance statement

The balance sheet of a business essentially identifies its net worth. This gives a snapshot of your company’s health by indicating how much your company owns (its assets), and how much it owes (its liabilities). Examples of assets are cash, accounts receivable, inventory, prepaid insurance, investments, land, buildings, equipment, and goodwill. Examples of liabilities include notes or loans payable, accounts payable, salaries and wages payable and interest payable.

Income statement

A business’s performance or results is reflected in the income statement. Use this report to monitor when your business makes a profit or a loss at any time. This statement is generally divided into two parts: the operating and non-operating sections.

The operating items section reflects the revenues and expenses involved with the production, importing and selling. The non-operating items section discloses revenue and expense information about activities that are not tied directly to your company’s regular operations.

Cash flow statement

For small business owners, how you manage your money is especially important because your startup capital may not be enough to cover the daily expenses of your business, and so you would need to forecast and plan for cash coming in and going out as accurately as possible. Knowing and understanding what your business’s income is and where it comes from allows you to determine what you have in the bank to spend. This helps ensure that you can pay your suppliers and staff on time.

6. Managing business taxes

In addition to managing your incomings and outgoings, you need to make sure you’re on top of your taxes.This can be a daunting prospect, and you may want to seek advice from an accountant to help you navigate this. There are three key areas to be on top of: Self-Assessment, VAT and corporation tax.

1. Self-Assessment

Self-Assessment is a system HM Revenue and Customs (HMRC) uses to collect income tax. Once you’ve identified your business structure, you’ll need to register with the HMRC to file your taxes. You should register as soon as possible once you’ve started your business to avoid fines.

2. VAT

Value Added Tax, or VAT, is a tax that’s charged on most goods and services sold by VAT registered UK businesses. Unlike other taxes, VAT is collected on behalf of HMRC by registered businesses. Once you’re registered for VAT, you must charge the applicable tax rate on any products or services you sell.

If your business makes more than £85,000 over a 12-month period, or if you expect to make more than that over the next 30 days, you will need to register for VAT. If you fall below that threshold, it may be beneficial for you to voluntarily register. Being VAT registered may add to your business’s professionalism. Also, if you make a lot of purchases, you may be able to reclaim the value of VAT on these items.

There are several different VAT schemes that could help you save time and money.

How to submit VAT

If you’re VAT registered, you’ll need to submit a VAT return at regular intervals, usually every three months. All VAT returns must be submitted online through one of these methods:

- HMRC’s free online service – log in to your VAT online account at online.hmrc.gov.uk and manually enter the values.

- Purchase software (such as Sage Business Cloud Accounting) – HMRC has a list of approved software you can use to send your VAT return directly to the gateway. With this method, the values from the software are transmitted directly to your VAT online account.

- Authorise an agent or your accountant to submit your VAT return on your behalf

You’ll have to pay VAT to HMRC electronically. Direct debit is the most popular method.

Sending the return

All VAT returns must be sent online. You must create a VAT online account as part of the registration process. There are several alternative methods available to complete the online submission process:

- HMRC’s free online service – Log in to your VAT online account and manually enter the values

- Software you can buy – HMRC has a list of approved software you can use to send your VAT return directly to HMRC. With this method, the values from the software are transmitted directly to your VAT online account.

Staying compliant

To be compliant with VAT legislation there are two key things to bear in mind:

- You must keep your VAT records for at least six years. You can store them in paper form, electronically or within software. Records must be accurate, complete, and accessible.

- You need to make sure you create official VAT invoices.

The following 13 elements must be included on an invoice for it to comply with VAT regulations:

- Unique invoice number that is a continuation from your last invoice

- Your business name and address

- Your VAT number

- Date

- The tax point (or ‘time of supply’) if it is different from the invoice date

- Customers’ names or trading names and addresses

- Description of the goods or services

- Total amount excluding VAT

- Total amount of VAT

- Price per item, excluding VAT

- Quantity of each type of item

- Rate of VAT charged per item. If an item is exempt or zero-rate, make it clear that there is no VAT on that item

- The total of these values separately

Using software that creates invoices is the best way to make sure your invoices are always compliant. It’s important to stay on top of this – HMRC can contact or visit your business to inspect your VAT records for accuracy.

3. Corporation Tax

Corporation Tax applies to:

- Limited companies

- Any foreign company with a UK branch or office

- Clubs, co-operatives or other unincorporated association, (e.g. a community group or sports club)

As an owner of any of these business types, you are responsible for calculating and reporting your Corporation Tax.

You’ll also need to file your company tax return by the end of your accounting period. If you need help with Corporation Tax, you can:

- Appoint an accountant or tax adviser to help you

- Contact the helpline

7. Strategies for growth

You’re on top of your cash flow, financial monitoring and taxes. Here are some ways you can start to grow your business, starting with your existing customers.

Gather customer feedback

People who have bought from you are often the best judge as to what sells and why. From there, you can work out your most effective sales strategy. By unearthing what your customers need, and when, you can also predict demand. Follow-up each sale with a courtesy call, or send a customer service questionnaire.

Don’t forget about social media, the platform for opinions. It’s a gold mine for cost-effective ways to gather customer opinions:

- Sound out new products or services with your followers on Twitter and Facebook

- Check out competitor activity on social media

- Start a discussion thread in relative forums

Exploit cross-selling and upselling opportunities

Reach out to your existing clients by increasing either the range or the value of what you sell. If you sell online, use your website and email marketing campaigns to make recommendations based on customers’ buying habits.

Send email alerts

Alerting customers on your database through emails or newsletters when new, improved or related products or services become available is another way of increasing sales.

Cater to your most valuable customers

Work out what your most valuable customers – the high-spending ones – really want from you. To encourage orders, you could offer discounts or special promotions to drive more sales.

Drum up referrals

Use your existing customers to drive referred new customers. This is usually a highly reliable way to bring in new business, especially if you give special discounts to buyers who refer your business.

Remember, no customer likes to be overly badgered with sales pitches, particularly if the product or service doesn’t meet their needs. Your marketing and sales campaigns need to be accurately targeted. Otherwise, your customers could lose their trust in you, jeopardising the relationship. Your goal is to build solid, long-term associations, not chase one-off profits.

Boosting profit: Tips from an expert

Emma Warren is a business expert, entrepreneur and managing director at Portfolio Directors, a gives advice to growing small firms. She gives her tips on how to boost profit.

- Manage your suppliers. Don’t be afraid to ask for a discount to boost your profit but don’t be so ruthless that it affects your relationship. Negotiating cheaper delivery slots – away from peak hours for instance – is often a good way to bring down costs.

- Manage your cash cycle by keeping accurate sales records. That way you can keep profit margins high and spot problems early on. Raw material prices going up might mean you need to increase your prices, for example. Or you might need to run a special promotion in quieter months.

- Talk to customers and suppliers to find out the latest innovations and trends and what’s ‘hot’. Be super alert to new ideas and what’s selling well in your sector – can you piggyback in some way?

- Make products and services repeatable wherever possible. Even if you must discount to achieve this, it’s usually worth it for the cash flow benefits. For example, if you’re a training company selling to corporate clients, offer a mixture of training and coaching over a six-month period with a regular fee each month, rather than just a one-off session.

- Encourage customers to commit to a purchase every month either through an email alert or newsletter featuring your latest ranges. Better still, gear it to your customers’ individual tastes and buying preferences. It’s cheaper and easier to keep customers than it is to set out to attract new buyers.