Sage Intacct Intelligent General Ledger Accounting Software

Intelligent General Ledger Accounting Software

Core Financials

Transform your business strategy and processes with continuous accounting, trust, and insights with the only Intelligent GL™ powered by AI.

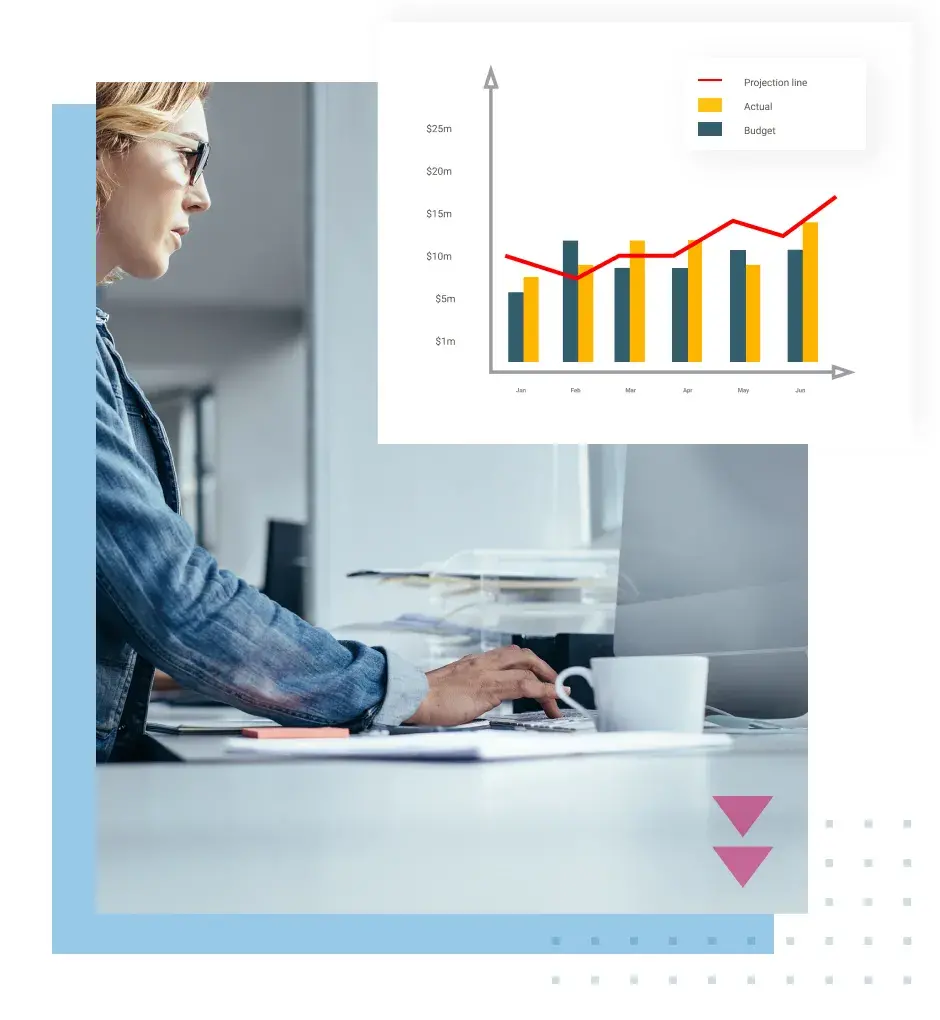

Transform your business processes with a modern, cloud-based architecture and artificial intelligence

Sage Intacct’s modern, cloud-based architecture provides the flexibility and efficiency you need to adapt to change and growth. Our core financials are configurable by a business user—no developer needed.

- Simplify your chart of accounts using dimensions

- Enter transactions once and report on them across multiple financial standards

- Define your own workflows

- Set guardrails for consistency and accuracy

- Close continuously instead of saving it all for period end

Transform your business strategy through agile, data-driven decisions based on trusted data

Don’t wait for the close to get the information you need. Only Sage Intacct uses the power of AI and automation to deliver continuous accounting, trust, and insights.

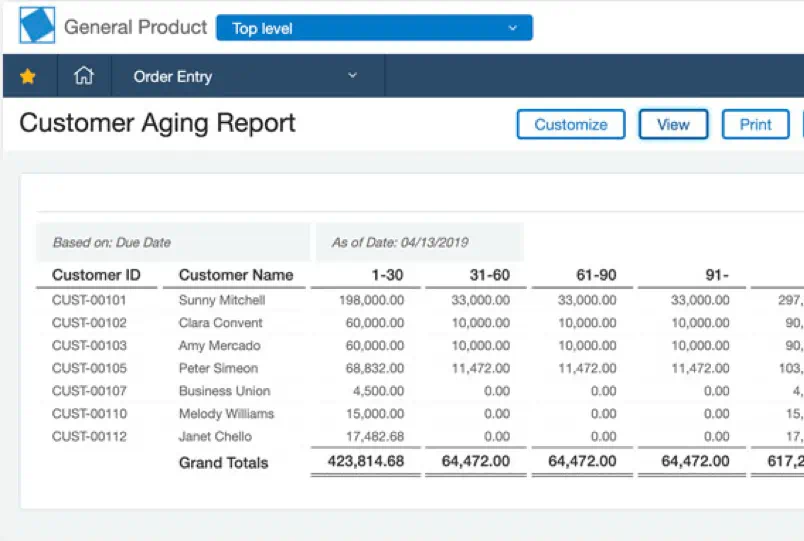

- Capture, post, and report on transactions in real-time.

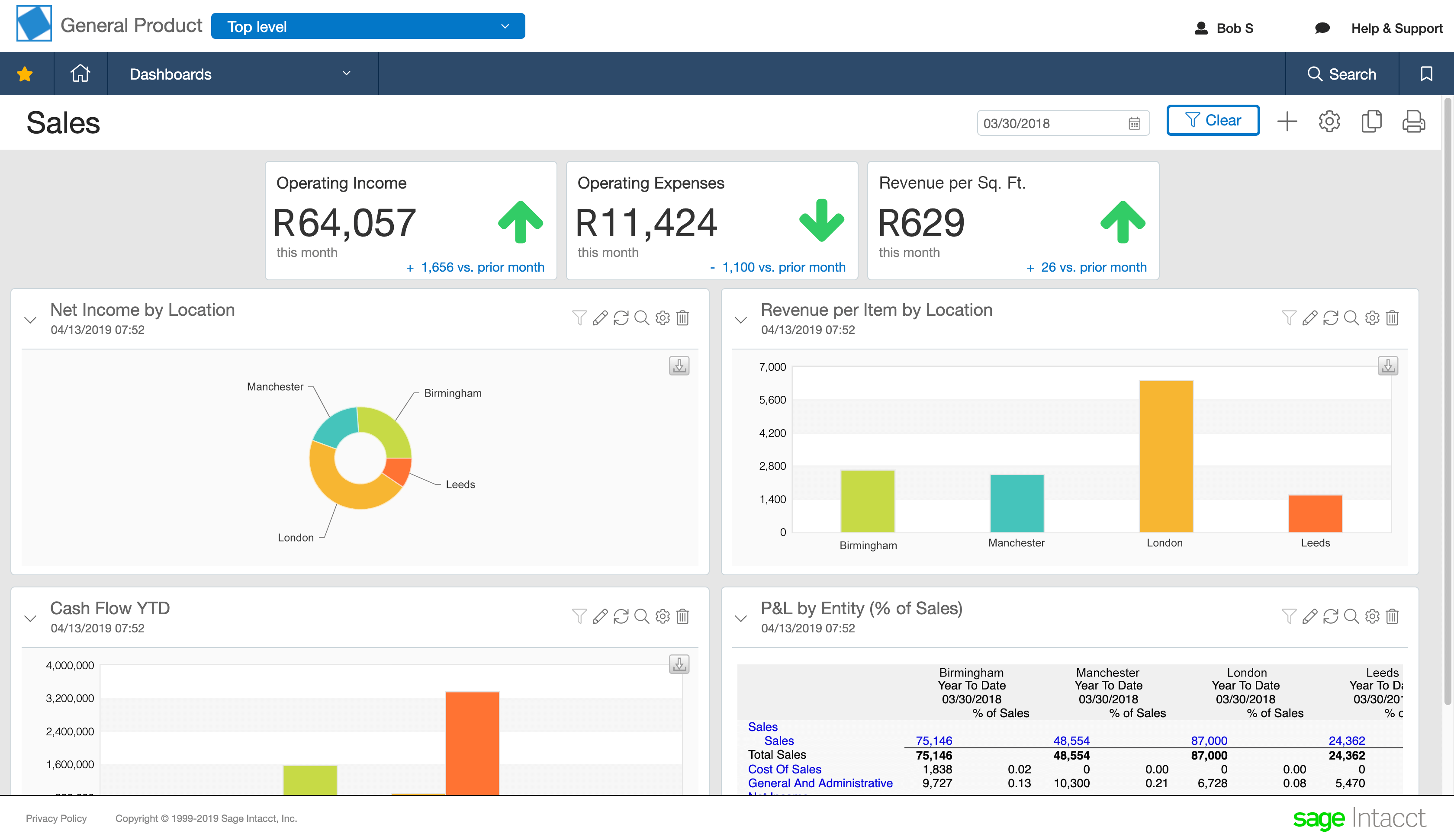

- Get instant, multi-dimensional insights with dashboards and one-click drill-down to source transactions.

- Share insights flexibly and securely with only those who need it.

- Review thousands of GL transactions in minutes using AI-based outlier detection to gain trust in your numbers.

- Eliminate the need to build reports outside of your financial solution.

Read how Village Family Dental navigated the COVID-19 pandemic and gained

- 930% faster departmental reporting

- Visibility of location and provider performance to maintain gross margin targets

- 70% shorter monthly close cycle

- 25% efficiency improvement

- Huge savings through avoided headcount

Learn how MidCap Credit and Capital was able to scale their multi-entity business and

-

Save 16 hours per month on global consolidations

-

Achieve software payback in less than 7 months

-

Gain trusted insights into business KPIs

Transform your multi-entity operations with continuous consolidations

Sage Intacct automates multi-entity processes so as your entities multiply, your workload doesn’t.

- Create and modify entities and hierarchies without a new implementation.

- Centralize and automate inter-entity transaction instructions to reduce errors and save reconciliation time.

- Automate currency rate tables and conversions, eliminating errors and saving hours of manual calculations for high transaction volumes.

- Continuously consolidate financials and maintain drill-down visibility.

Learn more about Sage Intacct Intelligent General Ledger

If you are interested in finding out more about how Sage Intacct Intelligent General Ledger Software can speed up your workflow and streamline your business, click the contact us button below and we will be in touch with you.

Kiteview Technologies (Pty) Ltd was founded in May 2010 to provide the Sage Evolution Business Management solution to the SME market. The management team of Kiteview have combined +30 years of experience in the delivery of small to mid-market Financial & Business Management solutions. This experience, combined with a sound project implementation methodology has helped in Kiteview’s growth, becoming a Platinum status partner for SAGE Pastel within just 1 year.

Contact Us

For An Obligation Free Quote