3 Reasons why accountants should embrace AI and Machine Learning

Article credit: Sage

Artificial intelligence (AI) and automation have taken the accounting profession to a point of pivotal change, and it’s about to transform the way that accountants operate.

AI is already great at automating repetitive accountancy tasks, which improves accuracy and productivity, and helps firms to discover hidden insights and trends that affect their clients’ businesses. It can automatically upload documents, understand entries, and classify them using the right accounting codes.

This has enabled accountants to do more with fewer resources and has freed up time and energy for creativity when it comes to analysing and interpreting data to extract real value for clients.

Many professionals are excited by the benefits that AI can offer. According to our Practice of Now report, the majority of South African respondents (82%) agreed that they need to increase the pace of technology adoption to stay competitive.

Now, as advances in AI and machine learning (ML) pick up the pace, three additional benefits have emerged: invisible accounting, continuous auditing, and dynamic insights.

1. Invisible accounting

At the beginning of 2020, over half (54%) of South African accountants were moving away from traditional service models and were reinventing their core technologies, recruitment approaches, and skillsets to offer customers an end-to-end consulting service.

They were able to do this because AI had eliminated repetitive tasks from the daily workload and increased the amount of readily available data and, therefore, intelligence to understand the current health and direction of their clients’ businesses.

2. Continuous auditing

Nearly all South African accountants (90%) say that the ongoing effects of technology advancement and digitisation are forcing them to move faster and invest more to keep pace with the market.

Artificial intelligence can help accounting firms to build trust through better financial protection and controls.

As the volume of online transactional data increases, so does the potential for financial fraud, manual accounting errors, and dishonest payments. This has made compliance a lot more complex. But AI can review the data at speed.

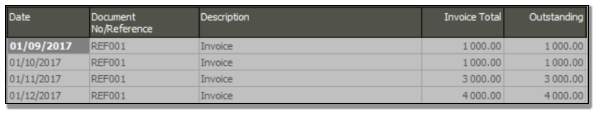

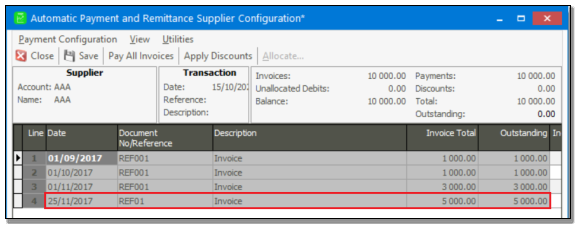

It can detect anomalies like duplicate invoices, determine links between seemingly normal (but not) payments, and assign expenses to the correct categories, so the business doesn’t pay out for items it shouldn’t.

Automated anti-fraud and finance management systems help practices to significantly improve compliance procedures. In implementing predictive, strategic services to protect their own and their clients’ finances, they’ll also be able to pick up on potential issues before they arise.

What’s more, AI lets accountants capture business activity in real-time, perform continuous reconciliation, and make adjustments such as accruals throughout the month, which reduces the reporting burden at the end of the financial period.

3. Dynamic insights

Two-thirds (65%) of South African accountants said that investing in technology had enabled them to provide a faster service, which positively impacts customer relationships, and nearly a third (29%) have invested in emerging technology in varying degrees.

AI’s ability to analyse large quantities of data at speed and at scale allows it to deliver actionable insights in real-time.

In pulling data from customer demographics, past transactional data, and external sources, AI helps accountants to optimise their workflows, make better business decisions, and puts them in a position where they’re looking forwards with clarity, rather than backwards with obscurity.

For example, by using data to perform cash flow forecasting, the business can predict when it will run out of money and act before that happens. And, by uncovering patterns in customer behaviour before they churned, AI can help businesses to understand why customers leave and how they can improve their retention strategies.

This means that accountants can help clients to respond to financial challenges before they become acute, by adjusting spending or processes as required. And, as AI advances, accountants will soon be able to provide predictive consultancy beyond classic financial planning to incorporate other areas of the business.

Same, but different

The accounting profession is evolving and becoming more sophisticated. While the rules of finance remain the same, the rules of how the work is done are shifting.

AI can speed up the profession from a traditional “bookkeeping” function to delivering dynamic insights that can drive strategic decisions and transform accountants from number-crunchers into true changemakers.

Kiteview Technologies (Pty) Ltd was founded in May 2010 to provide the Sage Evolution Business Management solution to the SME market. The management team of Kiteview have combined +30 years of experience in the delivery of small to mid-market Financial & Business Management solutions. This experience, combined with a sound project implementation methodology has helped in Kiteview’s growth, becoming a Platinum status partner for SAGE Pastel within just 1 year.

Contact Us

For An Obligation Free Quote