How long does it take for your customers to process your invoices and pay for your goods or services? And how many awkward conversations do you have to have along the way?

The average waiting time to be paid is 71 days. That’s substantially longer than the standard 30 or even 60-day terms most businesses rely upon to keep their cash flow healthy.

Sage’s own research reports that more than 1 in 10 are paid late. The research also found that across the world, the most common excuse given for late payments is… no reason at all.

That’s right. As incredible as it sounds, businesses simply have no excuse. They simply don’t bother paying on time.

As any business owner or finance professional knows, this can lead to tricky and often awkward phone calls or emails when a payment is overdue. According to the same Sage research, for most businesses, the biggest barrier to chasing payments is protecting the relationship with the customer or client.

Here are five ways to sail the choppy waters of invoice payments that should make those awkward conversations easier to navigate—or possibly remove the possibility of them ever arising in the first place.

1. Invoice immediately

If you take your time issuing an invoice then you send an implicit message to the customer or client that you don’t consider timely payment to be important either.

Sending a late invoice certainly won’t give you the strongest position should there be a requirement to contact the customer or client and chase the payment.

Issuing an invoice later rather than earlier can also create confusion for the customer or client, in that the time that’s elapsed might mean it’s not obvious what the invoice relates to. The person controlling the purse strings may have to investigate, which adds yet more potential for a delay until the payment is issued.

How soon should you send an invoice? Well, how about immediately?

If you use a modern accounting solution complete with a mobile app, you can even do this in front of the client.

Just completed a job or handed over some stock? Create and send the invoice there and then using a phone or tablet, and make sure the customer or client knows you’ve done so.

Following this, there can be no ambiguity about whether they received the invoice should you need to chase it up.

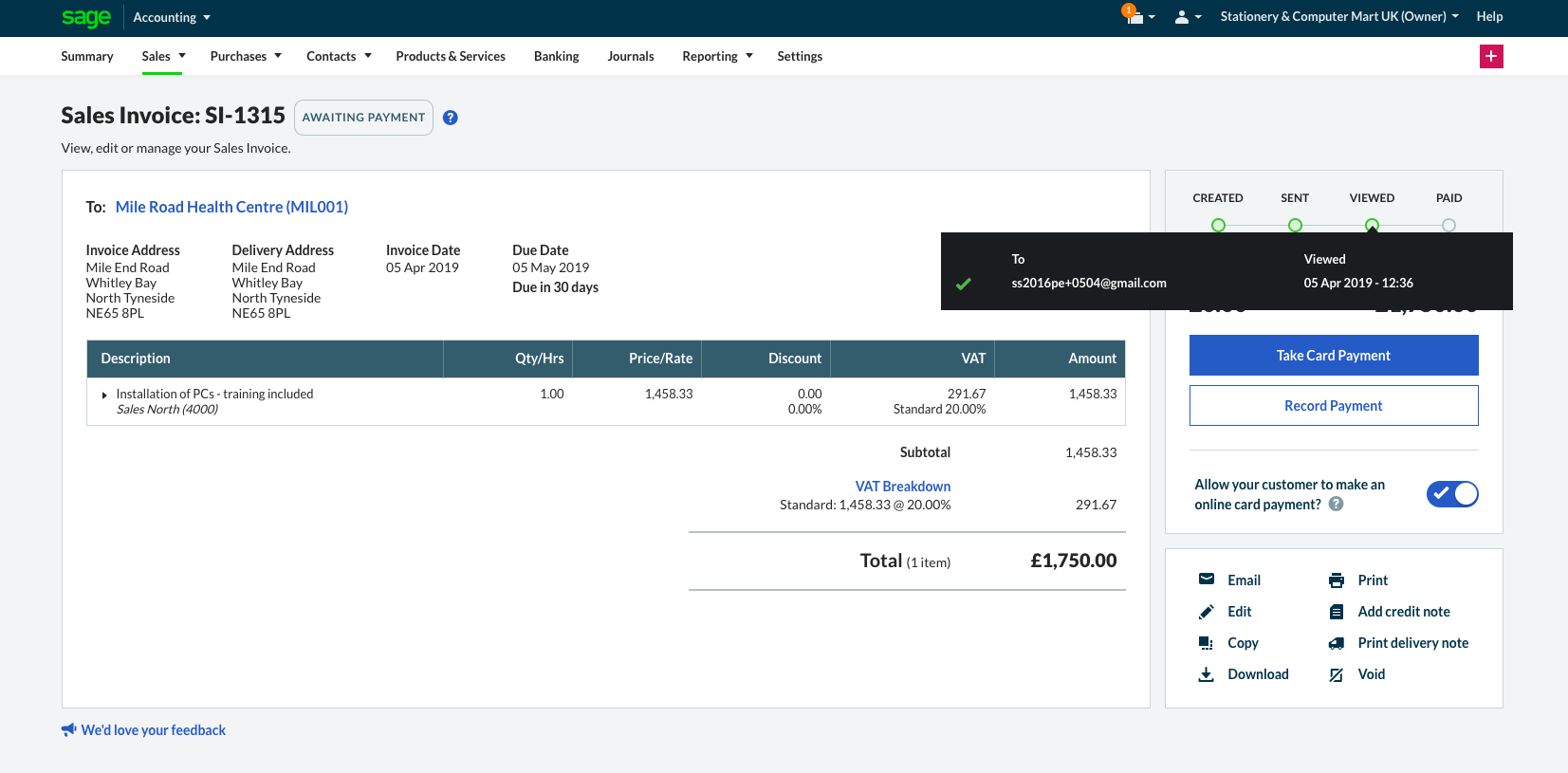

2. Offer many ways to pay

This point is a total no-brainer in the modern day and age. Any invoice your business issues must offer as many payment options as possible.

Credit card, debit card, bank transfer, PayPal, or even technologies such as Apple Pay or Google Pay. All should be offered in addition to the age-old methods of posting a cheque or arranging a bank transfer.

If you use modern accounting methods, your accounting software should let you include a “Pay Now” button in the email invoice that lets the recipient settle the invoice with just a few clicks.

This makes it as convenient as possible for your client or customer to settle the invoice, thereby eradicating the potential for procrastination.

Should you find yourself having to chase the payment, any awkward conversations are lessened if you can demonstrate how you’ve tried hard to make it as easy as possible for your client or customer to make their payment.

Even business-to-business (B2B) companies, some of which still rely largely on cheques or BACS, are coming around to the idea of paying electronically via more contemporary methods. Always ensuring your invoices offer this option is surely a step in the right direction.

Depending on the amount of the invoice, offering a variety of payment methods means it might even be possible for the person who authorised the purchase to pay it as an expenses claim.

This removes the need for the finance department to get immediately involved, which therefore removes further potential delays.

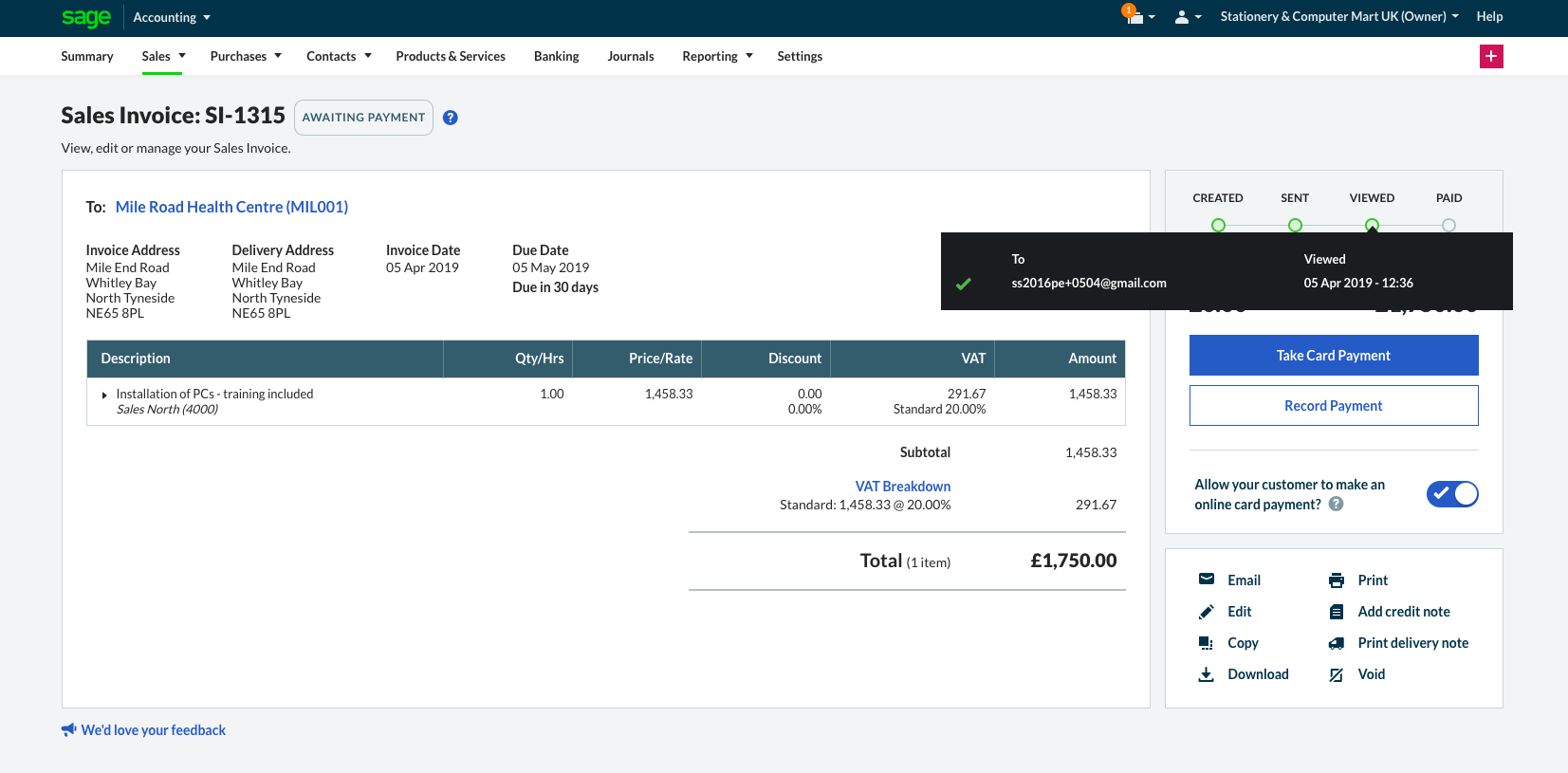

3. Know when invoices are read

A cutting-edge feature in accounting software shows a document timeline for invoices. As well as showing exactly when you sent the invoice, it lets you know when invoices have been viewed by the recipient.

This works in a similar fashion to the way some email applications let you know when an email has been opened by the recipient. You’re even informed of the time and date the invoice was viewed.

As such, you have some ammunition during the awkward conversation if the invoice requires chasing. If the client or customer says they didn’t receive it—perhaps the most common excuse—you can explain not only that they did indeed receive it, but even tell them exactly when they did.

That you can demonstrate the length of time since they became aware of the invoice means they are subsequently under pressure to settle it sooner rather than later because both you and they are aware the clock started ticking at that point, rather than at some nebulous point since then.

Additionally, now they know your invoices can be tracked in this way, they’re less likely to delay paying them in the future.

4. Make invoices clear, accurate and attractive

There’s a handful of details that must be included on an invoice but, beyond this, a clear and presentable invoice is something that demands action on behalf of the recipient.

The more professional the invoice looks, the more professional a response it’s likely to engender in the recipient—and this means the invoice is more likely to be paid on time.

All of us are unaware of subconscious cues that dictate our actions and in our professional lives, we tend to respond to professionalism with our own level of professionalism.

Ensure you provide the information you have to on the invoice, but also ensure any information the customer or client requires is also included, such as:

- The purchase order number

- The name of the individual or department that placed the order

- A concise description of what’s being invoiced for.

This will help avoid delays when they’re processing it.

However, don’t include too much information because you want the key information to be visible immediately.

Many accounting packages include a variety of invoice template designs that you can choose from. You might even choose to experiment with using each temporarily, to see which of them gets the best responses from businesses in terms of timely payments.

5. Set up regular payments

If your business provides regular goods or services to a business on a repeatable basis, why not set up regular payments with the customer or client? Then you can be sure the money will be collected on the invoice due date.

It’s good for the customer or client, too, because they don’t have the administrative overhead each time of having to raise the payment.

Even the smallest businesses can create direct debits for their customers or clients using their accounting software and a provider such as GoCardless, Stripe or PayPal.

The charges are comparable with other forms of electronic payments but the benefits go way beyond just receiving regular payments without having to chase them. Payments are automatically reconciled when received into your accounting software, so the background processing work requirement is also reduced.

A direct debit set up for a client or customer doesn’t just need to be used for regular payments, of course. You can set one up and use it to claim payments as and when required on a semi-regular basis.

Again, the reduction of administrative overhead for both you and the client compared to traditional invoicing and payment collection can be very attractive.

Conclusion on getting invoices paid

Conversations with your customers or clients should be productive and proactive, rather than awkward and strained.

By using the techniques highlighted here, you should be able to turn around your invoice payments processes so awkward conversations to chase up money become a thing of the past, or at least less of a strain on your time and emotions.