Most people in business know when things go wrong. They know very well, too, how things should be changed when this happens.

Yet, the actual detail required for improving things can be beyond their control, especially in a busy environment where day-to-day grind eats up time. Sitting down and thinking about how to do things better for hours at a time isn’t a luxury most of us have.

In this article, we provide some starting points. We explain how making smarter business decisions doesn’t have to be difficult. None of the five tips below are especially complicated, and all can be implemented slowly, by taking slightly different approaches while doing the same old tasks. If nothing else you might find they provide inspiration for you to start thinking about how to improve.

Many of the tips focus on making better use of the data generated by your business. Data can create insights that lead to these smarter business decisions. Nowadays any business generates vast amounts of data on a daily basis. Rather than simply ignoring it, making use of this can be revolutionary. It’s what successful corporations credit to their success over recent decades. And the technology needed to harness it has now trickled down to software for even the smallest business via tools like their account package or other business management tools.

1. Create a level playing field

Establish which analytics and data tools will help you achieve them, and adapt them throughout your company. Often, it’s about selecting the platform your cloud software will operate on, or a particular provider that takes the same approach with all their software packages to ensure compatibility. In doing so, you will keep everyone on the same page. Operational silos can not exist where a department or organization is out-of-bound to the rest of the business and jealously guards its data! Facilitates easy touch. Easy communication will be facilitated.

. Instead, everybody will be working together by design, measuring your data in the same way and using the results to keep improving.

For managers, this level of integration creates a level playing field that makes it easy to see at a glance what the state of the business is. They can see where success can be found, and where improvements need to be made – all without having to ask anybody, request reports, or call in outside help. All they need do is look at the dashboard within their application to see the benefits of easy collaboration.

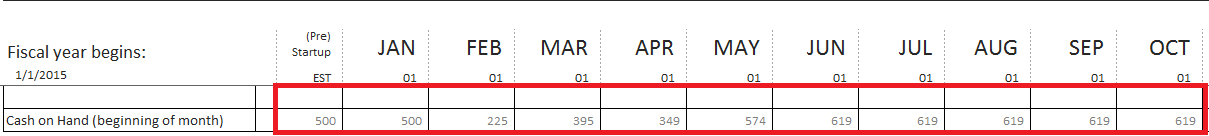

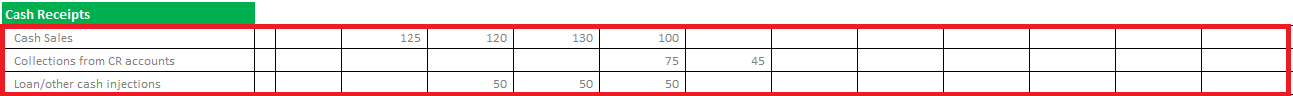

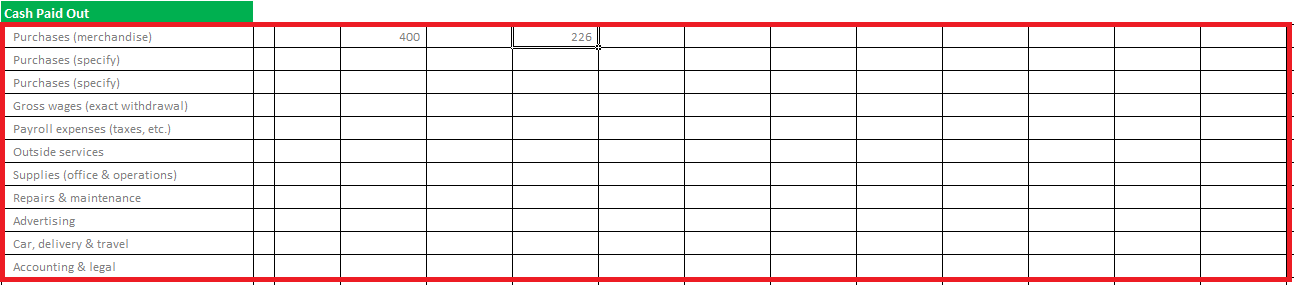

2. Know when to drop the spreadsheet

Spreadsheets are amazing things. We don’t need to tell you that. But while they have uses, you need to know when to put your spreadsheets to one side and switch to tools that are better suited for the job at hand.

Don’t get us wrong. We’re not saying get rid of them forever!

But you might consider switching to using cloud-based software that presents a unified set of data, integrated with all organisational functions so you and your team can rapidly access the information needed to make the decisions that count.

Here’s an example. Your CRM used by the sales and marketing team can work with your finance tool, to provide the best visibility into what’s happening right now. Decision-makers will get the knowledge they can trust, without the need to take special measures, and this breeds the confidence to make the right decisions.

How do you break a spreadsheet addiction? Well, it might help to remember that they make it difficult to enact modern data protection regulations. If the spreadsheet contains any personal data it should have security built-in by design, or your organisation could get into very hot water! But aside from applying a password, there’s not much else you can do.

Is it time to ditch that spreadsheet for something better?

3. Use the best analytics available

Financial or accounting tools designed to use your company’s data to provide insights will probably come with ready-made reports, dashboards and other analytics. But you might choose to create customised versions specifically for your needs. You could build a personalised dashboard with the specific metrics for your business health that you can view at any time and from anywhere.

Most software makes this pretty easy, but you can also hire a third-party to create them for you.

The difference between a ready-made dashboard or report, and one custom-created for your needs, can be like night and day. The benefits it can bring to you and your business, in terms of instantly knowing the state of play and being able to make decisions instantly rather than based on historical data, can make the difference between your business breaking new ground, or failing. It really is that profound.

4. Look out for inefficiencies

Consider the processes that run your business. Just as a healthy mind needs a healthy body, executive decisions can only be effective if the organisational structures that underpin them are primed for the times.

Finance is a case in point. As we’ve mentioned above, antiquated behaviours used by accountants and businesses—desktop spreadsheets and handwritten bookkeeping—get a job done, but not in a way that can compete on the same playing field as more forward-thinking alternatives.

If you created a business right now, would you make it exactly the same as your current business? Why not? Why are you sticking with processes and tools that aren’t efficient?

If you visit a new business, you’ll probably notice another thing. They’re usually very agile. They’re prepared to change things quickly, without thinking too much about it, because they’re much closer to the operation of their business. And this is what seeking out inefficiencies can do for you – each inefficiency you remove takes you one step closer to the core of your operations.

5. Be open, not closed

If you spend some time with a successful, growing organisation, you’ll probably notice something. People share. They share data, they share ideas, they share methods for doing things, they share tasks. Sharing is second nature of them.

Make your data available to all who need it, whenever they need it. This isn’t always possible, of course, but always aim to have an open attitude. Even better is to centralise around a single interconnected platform.

Across the company, silos can be dismantled as employees work seamlessly through a single platform. This negates the need to synchronise and search for various documents hiding in different apps. The right information is always there, ready to share.

Encourage staff to share too. Build it into their KPIs, or other goals and measures. Ensure they know who to reach out to if they need assistance, and ensure that each request for assistance is not met with resistance but with a pragmatic assessment of how help can be provided.

Final words

In this article, we’ve discussed methods by which you can begin to make smarter business decisions. Although these are things you can implement right now, what we’ve really been discussing is a philosophical change within the way you and your business approach things. Utilising data effectively brings with it the need to change attitudes and approaches. This should be communicated alongside the fresh approaches discussed above.