Sage Intacct Accounts Payable

Accounts Payable Software

Core Financials

Cut your accounts payable processing time by 65% or more annually. Get real-time visibility with 24/7 access from any device.

Internal controls

Point-and-click controls

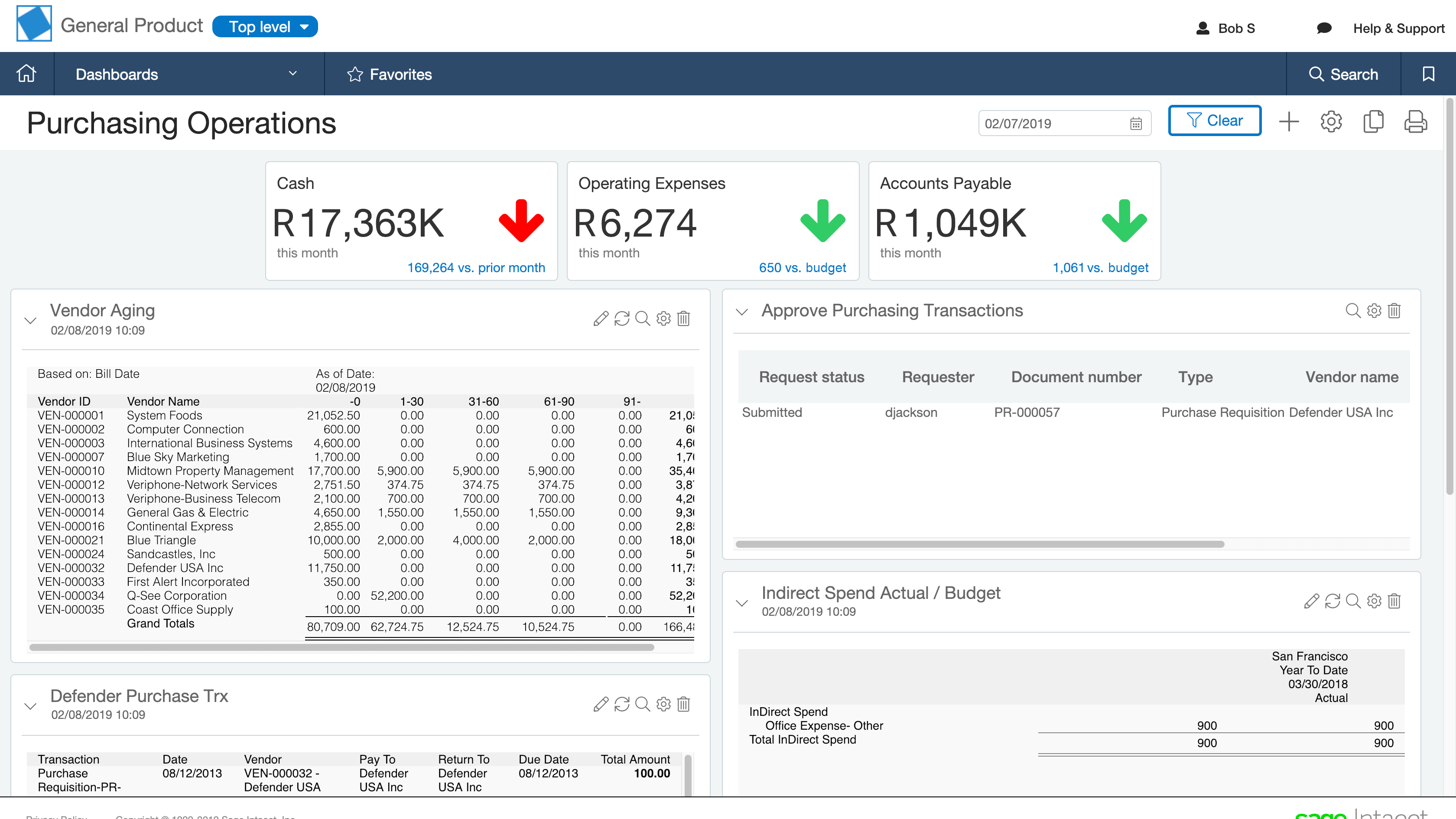

Real-time access to AP transactions and data

Predefined defaults

Reports on vendors, ageing, or payments

Minimize data re-entry & get broader insight across all financial functions

integration with Sage Intacct Cash Management, Inventory & Purchasing.

Automate accounts payable and save thousands of hours

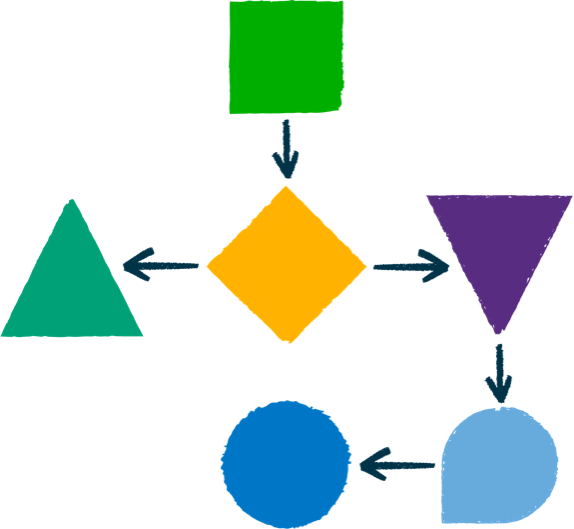

With Sage Intacct’s accounts payable management software, your business saves thousands of hours—and hundreds of thousands of pounds—by automating manual processes and eliminating inefficient workflows. Just point and click to configure approvals processes that work for your organisation.

There’s no time like real-time

With Sage Intacct accounts payable software, you can track and view payments, approvals, and reports—anytime, anywhere. See your accounts payable liabilities and vendor-ageing reports, and bill and check register reports across your business in real-time.

We keep you in control

Sage Intacct’s accounts payable solutions let you create automated, configurable processes to enhance internal controls and ensure complete accountability. You define the workflows and approvals so you have complete visibility into the entire AP process. You can even set spending limits to maintain budget compliance with Spend Management.

Kiteview Technologies (Pty) Ltd was founded in May 2010 to provide the Sage Evolution Business Management solution to the SME market. The management team of Kiteview have combined +30 years of experience in the delivery of small to mid-market Financial & Business Management solutions. This experience, combined with a sound project implementation methodology has helped in Kiteview’s growth, becoming a Platinum status partner for SAGE Pastel within just 1 year.

Contact Us

For An Obligation Free Quote