Dashboards and reporting

Dashboards

and reporting

Achieve real-time visibility into business performance.

Dashboards and financial reporting

Collaborate

Collaborate spans every process and device so your finance, sales, and services teams can cooperatively resolve any issue.

Sage Intacct Dashboards and Financial Reporting Core Features

Financial dashboards and reporting software that turns data into insightSage Intacct’s innovative general ledger includes 8 dimensions to capture the business context of your transactions, operational measures, and budgets. That means you can quickly access or create reports that analyse real-time business performance by business drivers – without managing a complex chart of accounts. Our 8 predefined dimensions are ready to go out of the box, including department, item, and employee. And it’s easy to add more dimensions to reflect unique business drivers and take your financial reports to the next level. |

|

Improve business agility while saving hundreds of hoursMost financial management systems can only handle financial data, but Sage Intacct tracks and reports both financial and operational data—like square footage, available hospital beds, SaaS metrics, or other granular measures that matter to your business. With all your financial and operational data in one place, Sage Intacct’s best-in-class multi-dimensional visibility enables you to slash time spent checking the accuracy of your financial data so you can start making strategic decisions that will impact your business. In addition to greater visibility, Sage Intacct Collaborate brings the whole team together by adding an additional secure social layer embedded in your Sage Intacct financial management platform. Collaborate spans every process and device so your finance, sales, and services teams can cooperatively resolve any issue. |

|

Get rich financial reports, your wayWith Sage Intacct, financial reporting and analysis options are almost limitless. Compare operational statistics with financial metrics. Check summary roll-up figures for multiple entities—even if it’s only mid-month. Drill down to source transactions for granular transparency instantly. Flag trends and spot exceptions with powerful report visualisations. With Sage Intacct dashboards and reporting, you can compare performance across any business driver that matters to you. You get 150 built-in financial reports as well as the ability to easily create custom reports. Forget Excel reporting, waiting for customised projects, or relying on external tools. |

|

Dive deeper and go further with financial dashboards and reportingSage Intacct’s interactive custom report writer lets you easily create real-time reports that tackle your toughest reporting needs. Get the insights you need in seconds to address complex issues and respond to market changes. Start with hierarchical field selection, drag-and-drop design, and automatic conditional formatting, grouping, and subtotals. Then go to the next level with calculated columns with calendar and math functions, conditional logic, rolling sums and aggregations, and pivot tables. And when you need specifics, just drill down to transaction details. |

|

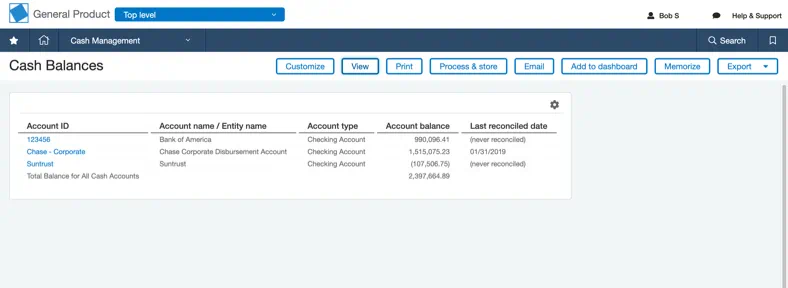

Financial dashboards and reporting software that turns data into insight

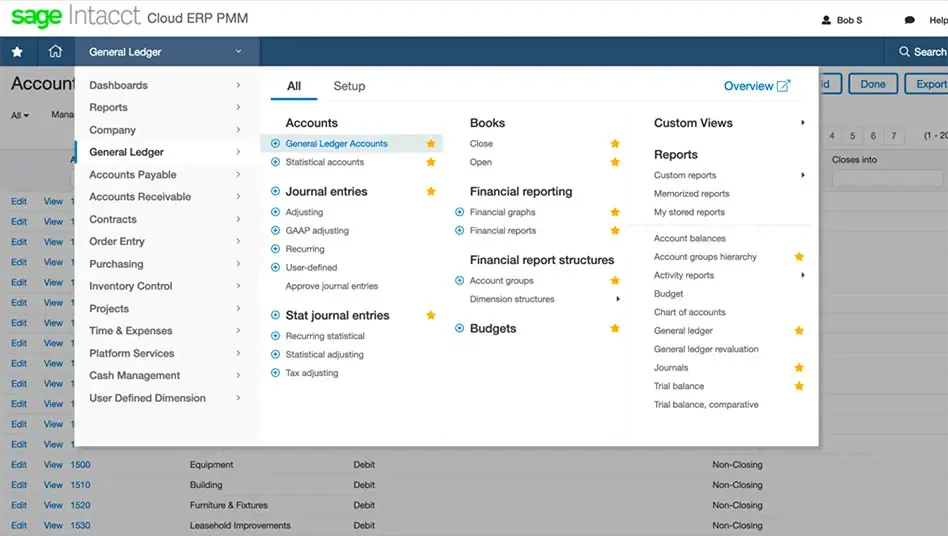

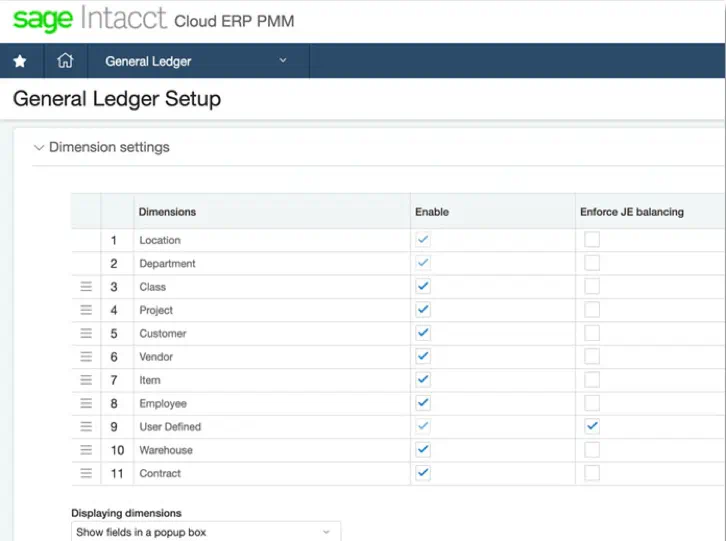

Sage Intacct’s innovative general ledger includes 8 dimensions to capture the business context of your transactions, operational measures, and budgets. That means you can quickly access or create reports that analyse real-time business performance by business drivers – without managing a complex chart of accounts.

Our 8 predefined dimensions are ready to go out of the box, including department, item, and employee. And it’s easy to add more dimensions to reflect unique business drivers and take your financial reports to the next level.

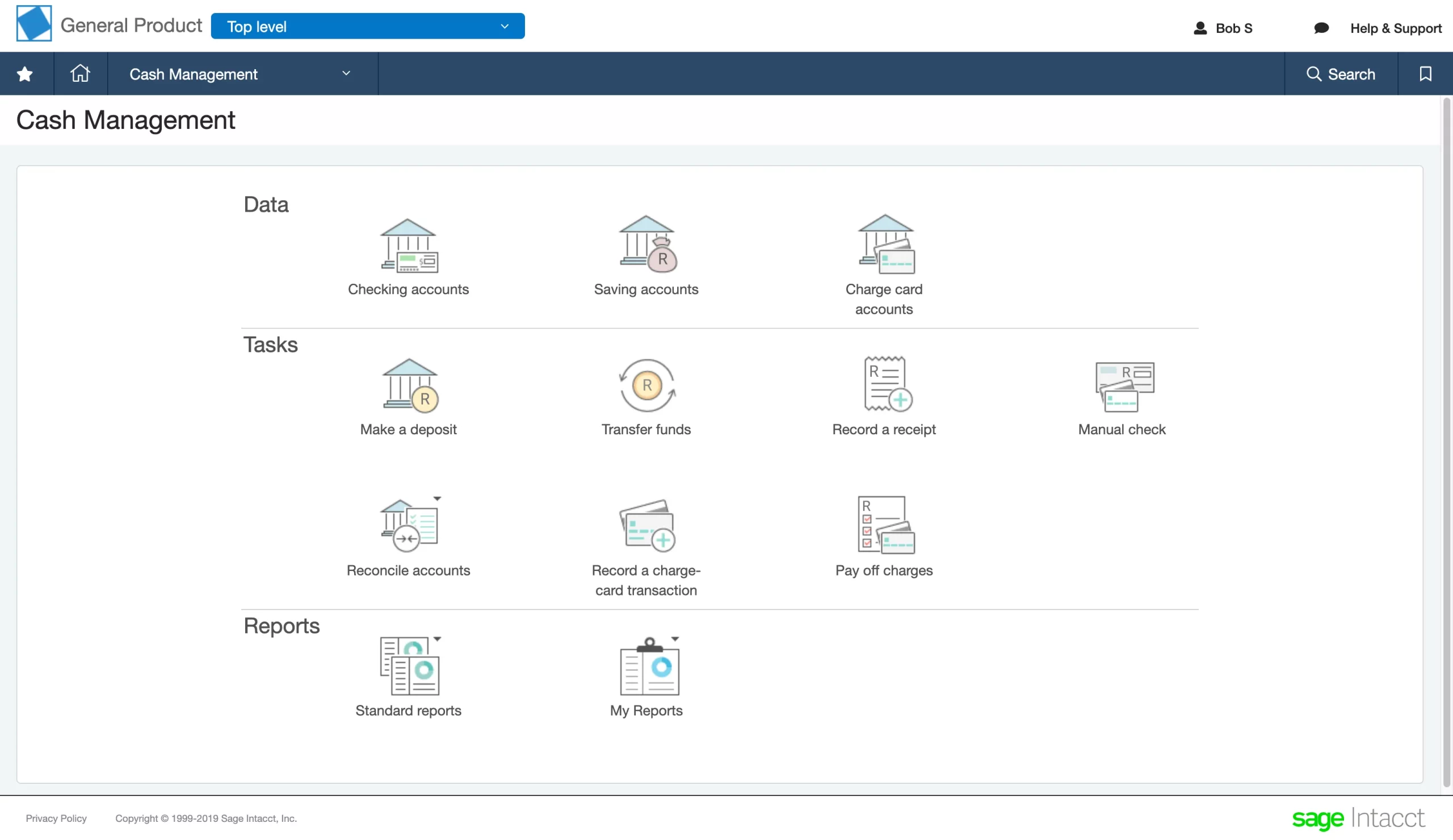

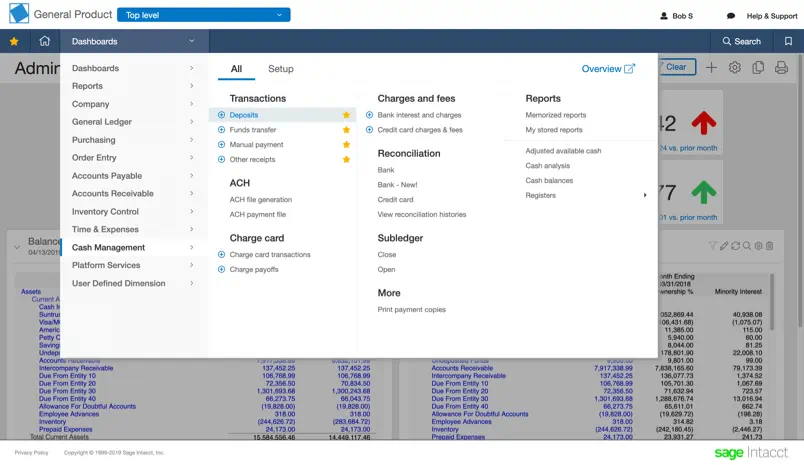

Improve business agility while saving hundreds of hours

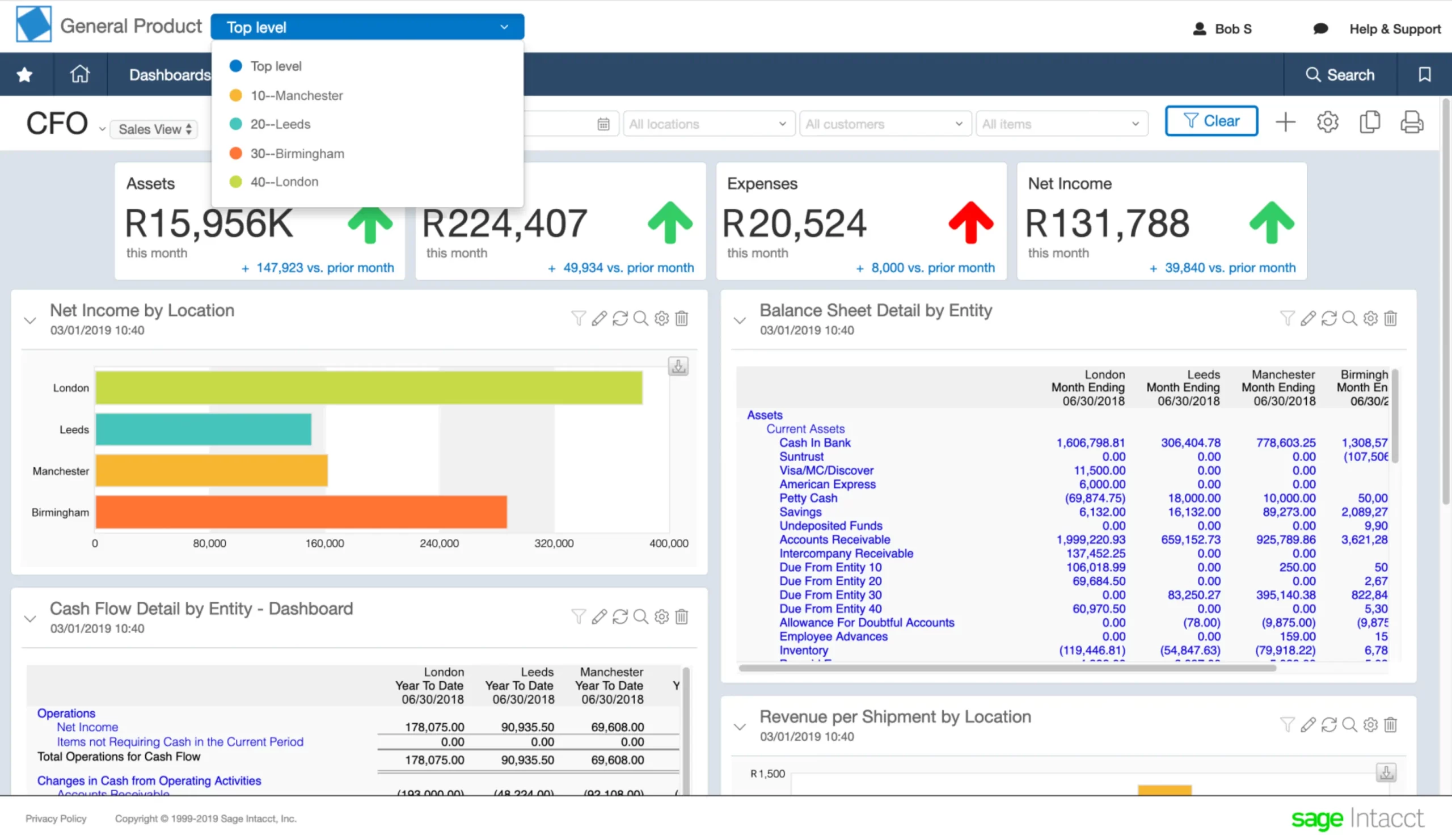

Most financial management systems can only handle financial data, but Sage Intacct tracks and reports both financial and operational data—like square footage, available hospital beds, SaaS metrics, or other granular measures that matter to your business.

With all your financial and operational data in one place, Sage Intacct’s best-in-class multi-dimensional visibility enables you to slash time spent checking the accuracy of your financial data so you can start making strategic decisions that will impact your business.

In addition to greater visibility, Sage Intacct Collaborate brings the whole team together by adding an additional secure social layer embedded in your Sage Intacct financial management platform. Collaborate spans every process and device so your finance, sales, and services teams can cooperatively resolve any issue.

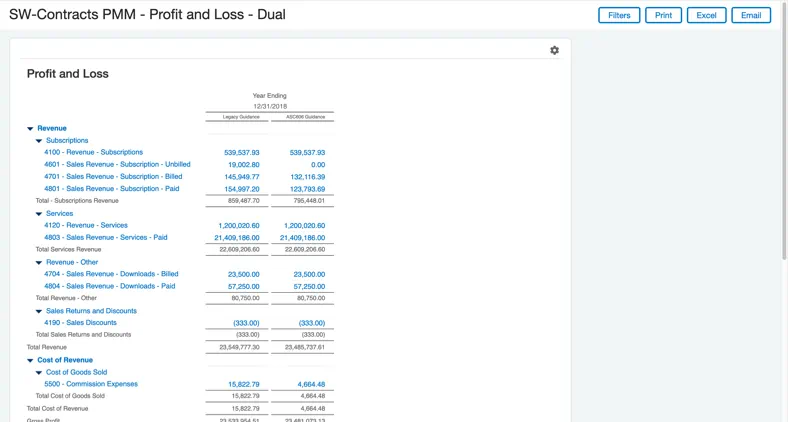

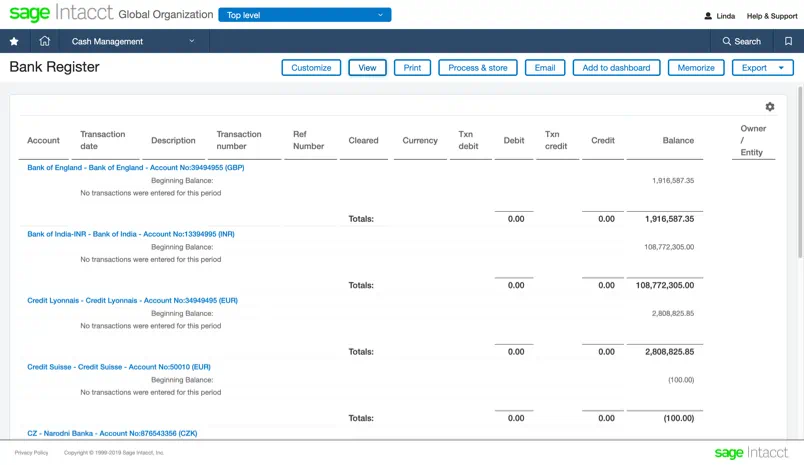

Get rich financial reports, your way

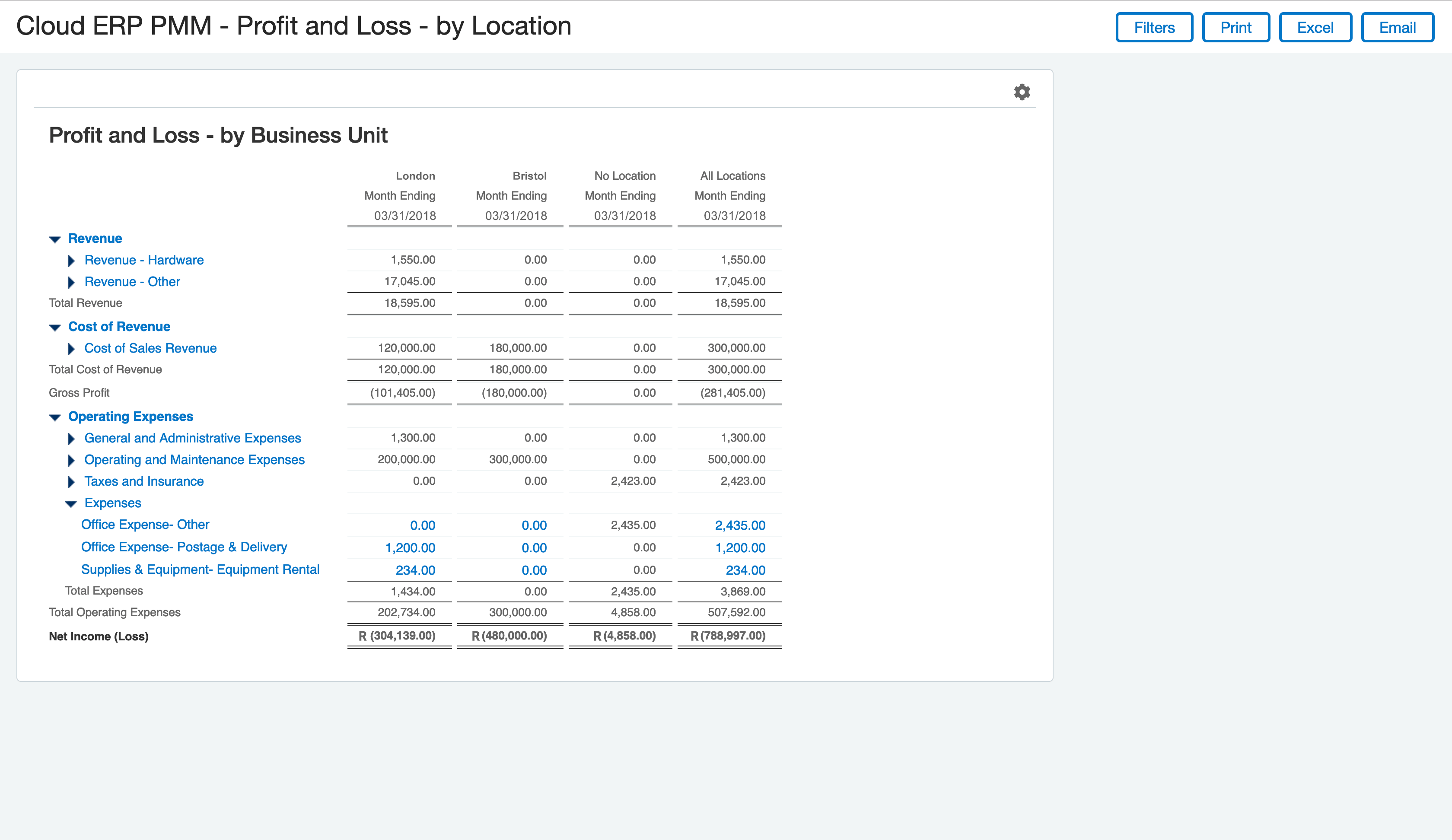

With Sage Intacct, financial reporting and analysis options are almost limitless. Compare operational statistics with financial metrics. Check summary roll-up figures for multiple entities—even if it’s only mid-month. Drill down to source transactions for granular transparency instantly. Flag trends and spot exceptions with powerful report visualisations.

With Sage Intacct dashboards and reporting, you can compare performance across any business driver that matters to you. You get 150 built-in financial reports as well as the ability to easily create custom reports. Forget Excel reporting, waiting for customised projects, or relying on external tools.

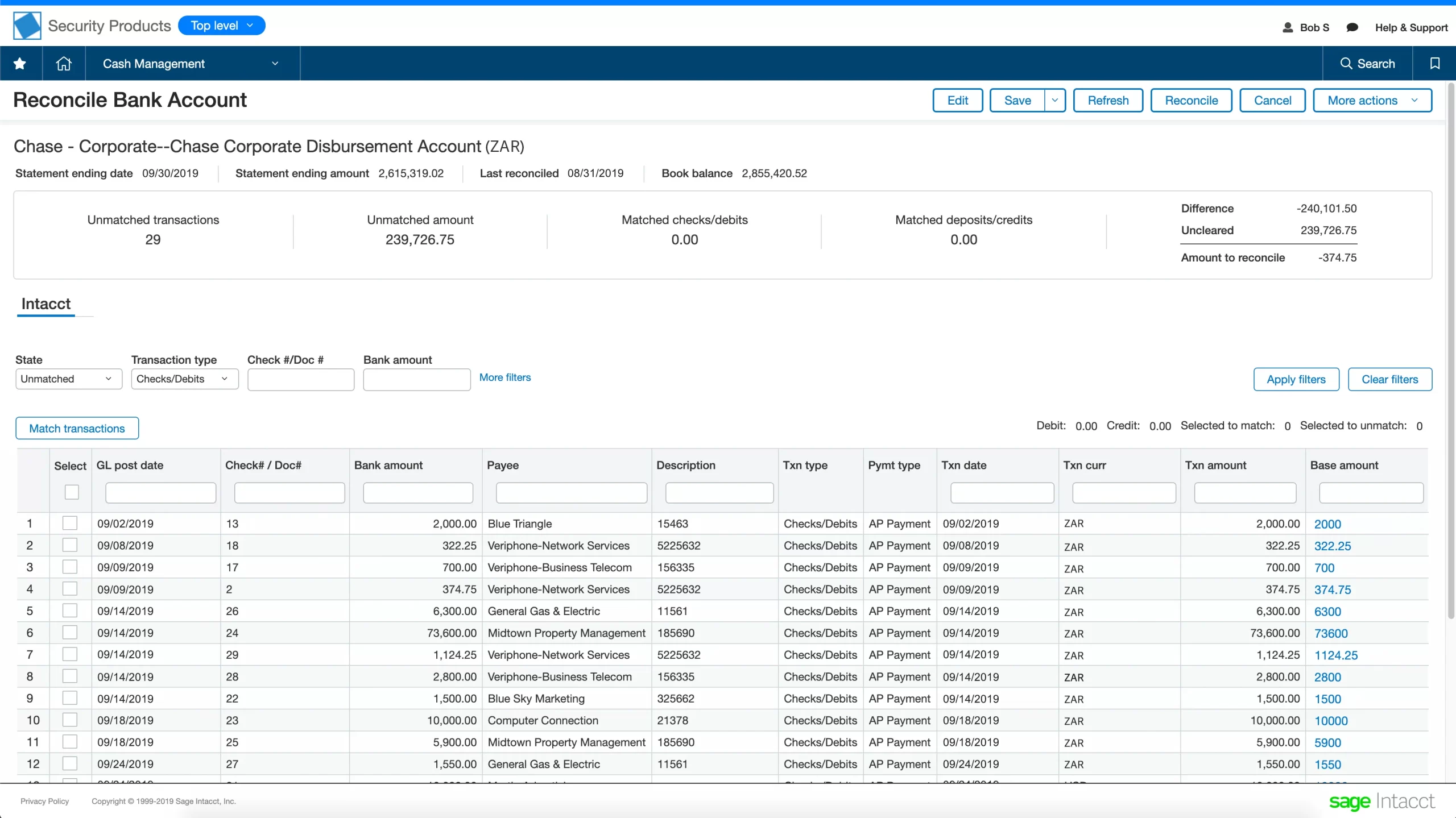

Dive deeper and go further with financial dashboards and reporting

Sage Intacct’s interactive custom report writer lets you easily create real-time reports that tackle your toughest reporting needs. Get the insights you need in seconds to address complex issues and respond to market changes.

Start with hierarchical field selection, drag-and-drop design, and automatic conditional formatting, grouping, and subtotals. Then go to the next level with calculated columns with calendar and math functions, conditional logic, rolling sums and aggregations, and pivot tables. And when you need specifics, just drill down to transaction details.

Kiteview Technologies (Pty) Ltd was founded in May 2010 to provide the Sage Evolution Business Management solution to the SME market. The management team of Kiteview have combined +30 years of experience in the delivery of small to mid-market Financial & Business Management solutions. This experience, combined with a sound project implementation methodology has helped in Kiteview’s growth, becoming a Platinum status partner for SAGE Pastel within just 1 year.

Contact Us

For An Obligation Free Quote