The Entrepreneur’s Guide To Accounting

Article credit: Sage

The health of your business’s accounting and financial systems plays a big part in your success. While it’s tempting to hire someone to take care of your finances for you or to ignore them altogether until tax season rolls around, managing your money smartly is a non-negotiable when it comes to running a successful business.

While no entrepreneur can be a master of all trades, it’s worth knowing the basics when it comes to your finances.

Here are eight things every new business owner needs to know about accounting:

1. Know your growth number

So, you’ve spent weeks perfecting your business plan, painstakingly highlighting your vision – but have you outlined your financial targets? Even setting a baseline goal of 5% growth per year, for example, can keep you focused and make it easier to measure your growth.

2. Consistency is key

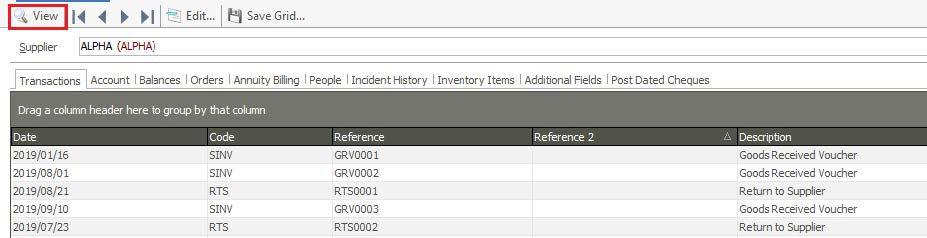

Set aside time every day or week to update your accounts, so you can get into the swing of managing your revenue, costs, and expenses. Having oversight of your finances will help you to make informed decisions and spot any financial red flags before they become serious.

3. Think ahead

Plot your income and expense projections up to the end of the financial year. This will help you to anticipate your future cash flow and makes it easier to adjust your operations in the future.

4. Value your time

Time is money. Entrepreneurs need to master time management because it’s one skill that can’t be outsourced. Keeping your most important vendors and customers happy is possible when you prioritise effectively and take care of the most urgent matters first.

5. Keep a sharp eye on your costs

You need to know your expenses inside and out. Whether they’re essential to your business or are more general (like stationery and printing), knowing where your money is going and being strict with your internal purchasing processes is paramount when it comes to managing your finances.

6. Guard your revenue

Being paid on time (in fact, being paid at all) can be a challenge. When invoicing your clients, be clear about when they can expect an invoice and what your payment terms are. Include these terms on the invoice itself and try to get the client to agree on them beforehand. Some clients might struggle to meet your payment terms; in those cases, you’ll need to compromise. Usually, it’s easier to wait longer for payment than to take legal action.

7. Do your future self a favour

Save yourself a stressful year-end by filing your financial documents every month. By storing your receipts, invoices, and other accounting documents in chronological order, they’ll be easily accessible whenever you need them.

8. Automate as much as possible

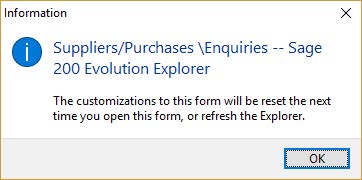

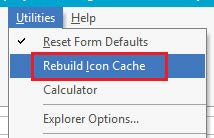

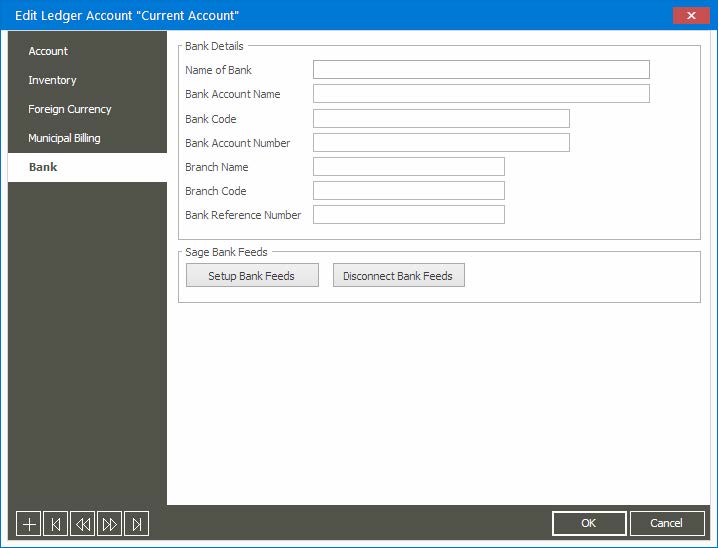

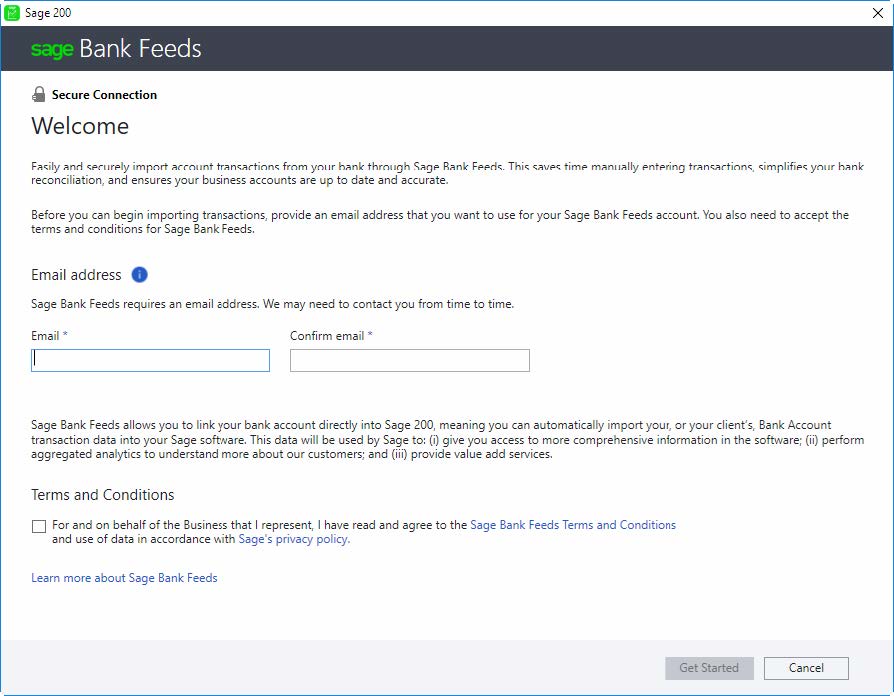

There’s no reason not to make the most of the technology available to us within our businesses – especially when it comes to our finances. Use whatever accounting tools and software you can to lighten the load of your workflow, set reminders, and ease the general day-to-day financial responsibilities.

Kiteview Technologies (Pty) Ltd was founded in May 2010 to provide the Sage Evolution Business Management solution to the SME market. The management team of Kiteview have combined +30 years of experience in the delivery of small to mid-market Financial & Business Management solutions. This experience, combined with a sound project implementation methodology has helped in Kiteview’s growth, becoming a Platinum status partner for SAGE Pastel within just 1 year.

Contact Us

For An Obligation Free Quote