Have you got a burning desire to start your own business? If so, you’re in good company.

Recent research says 28% of people worldwide have started a business at some point in their lives, while 30% have seriously considered it.

In other words, nearly a third of all people worldwide have considered going it alone.

If you’re serious about starting a business, you’ll need many things – but perhaps the first two you’ll need from day one are accounting software and a business plan.

The former lets you start on the very best footing without having to worry about an admin overload.

The latter is a way of transcribing your ideas and aspirations into cold, hard facts that investors can use.

For most people, creating a business plan is one of the hardest tasks they will undertake in the early days of their business.

Meet our business owner, Olivia

There are lots of business plan examples and templates. Using templates helps you answer questions that are typically asked if you hope to attract interest in your business – and therefore get investment.

Here, we look at creating a business plan via the hypothetical example of Olivia, who would like to create a plant-based chocolate retailer called Chocoholics Anonymous.

We’ll aim to create an ideal business plan by examining what she writes and how she approaches the task.

Olivia has already tested the water by running a part-time business from her kitchen for some months, with help from a few friends. Sales have boomed.

Now, she’d like to expand into a storefront and full online operation.

If she’s applying for a bank loan, she might be asking for most if not all of the funding. But if she’s hoping for angel investment, she may need to match the anticipated input with her own.

This might be her own cash, but it can also be her collateral in the business, and it’s for this reason that people often approach investors once their operation is an ongoing concern, rather than beforehand.

How to create a business plan

Olivia downloads our business plan template and sets aside an afternoon to make a start, realising it could take several days or perhaps even weeks to complete and perfect.

She realises this is one of the most important things she will do – more important, even, than the secret recipe for her fudge brigadeiros!

When answering the questions, she tries to remember who the business plan is for: investors, such as banks that she might be approaching for loans, or entrepreneurs.

For this reason, her plan contains as many data points as possible because it has to make a genuine case for her company’s existence.

But it also has to be positive and inspiring, to show the promise her business offers.

Additionally, this is one situation where she knows not to stop herself from including personality in the application. She knows investors are putting their money into her, as much as they are in the potential of the business.

In her business plan, she includes diagrams, charts, visuals and anything else that helps her share her vision.

And that makes the plan easier to consume – after all, investors are busy people, so she’s wise to make the job as easy as possible for them.

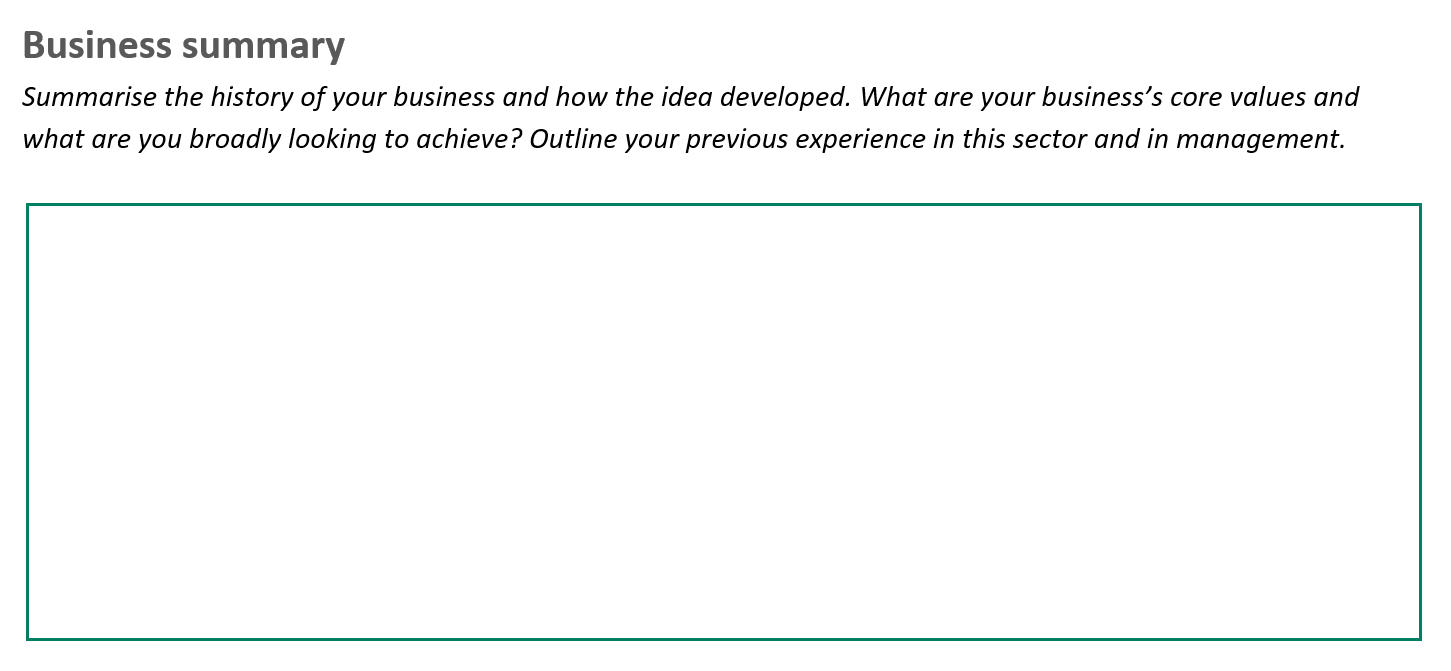

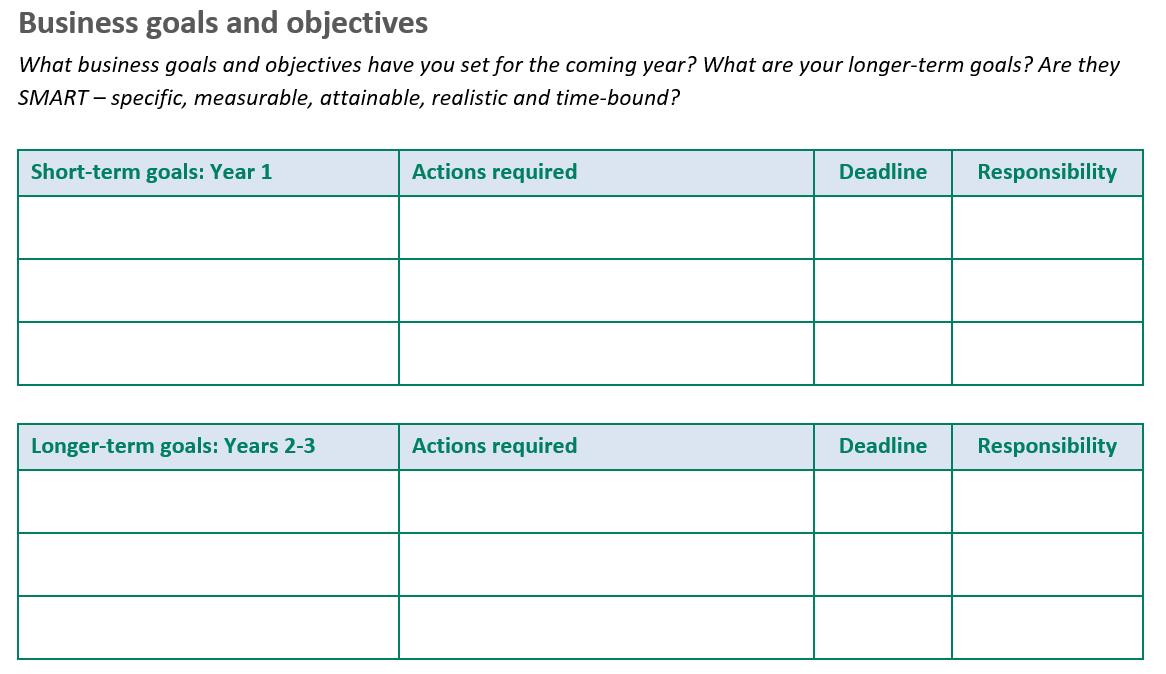

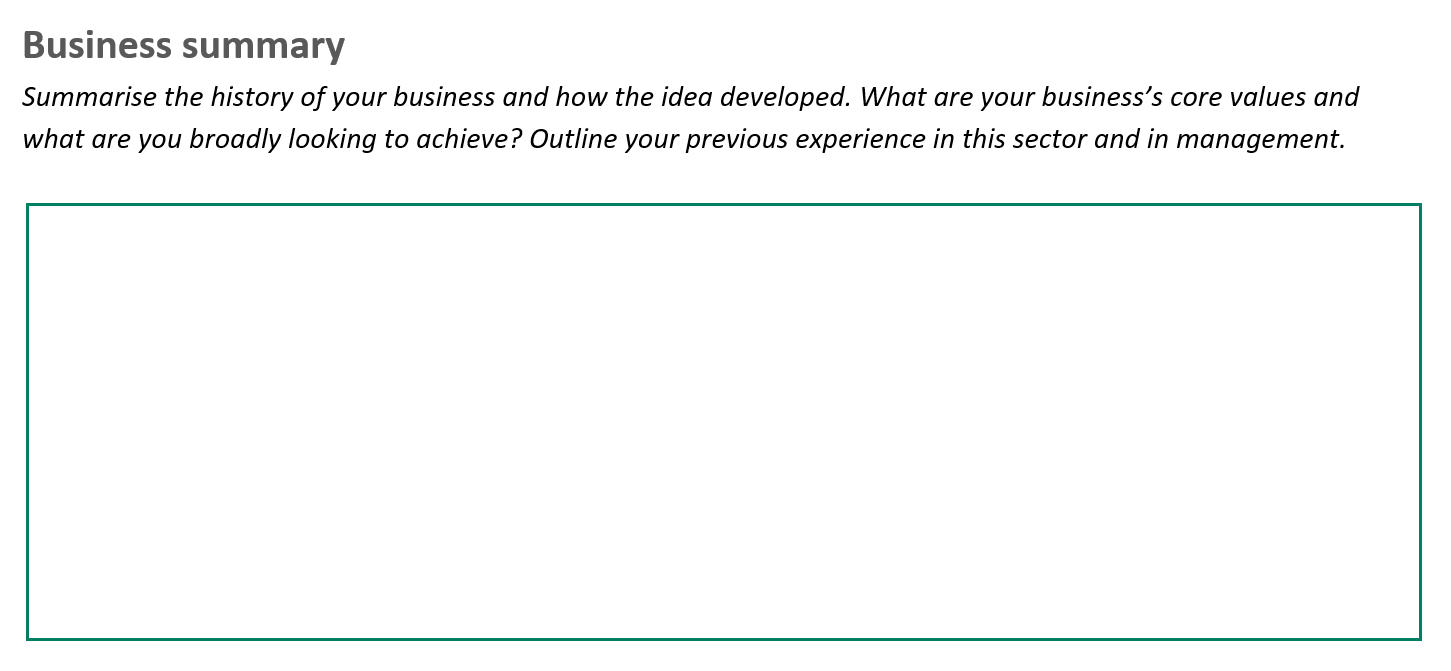

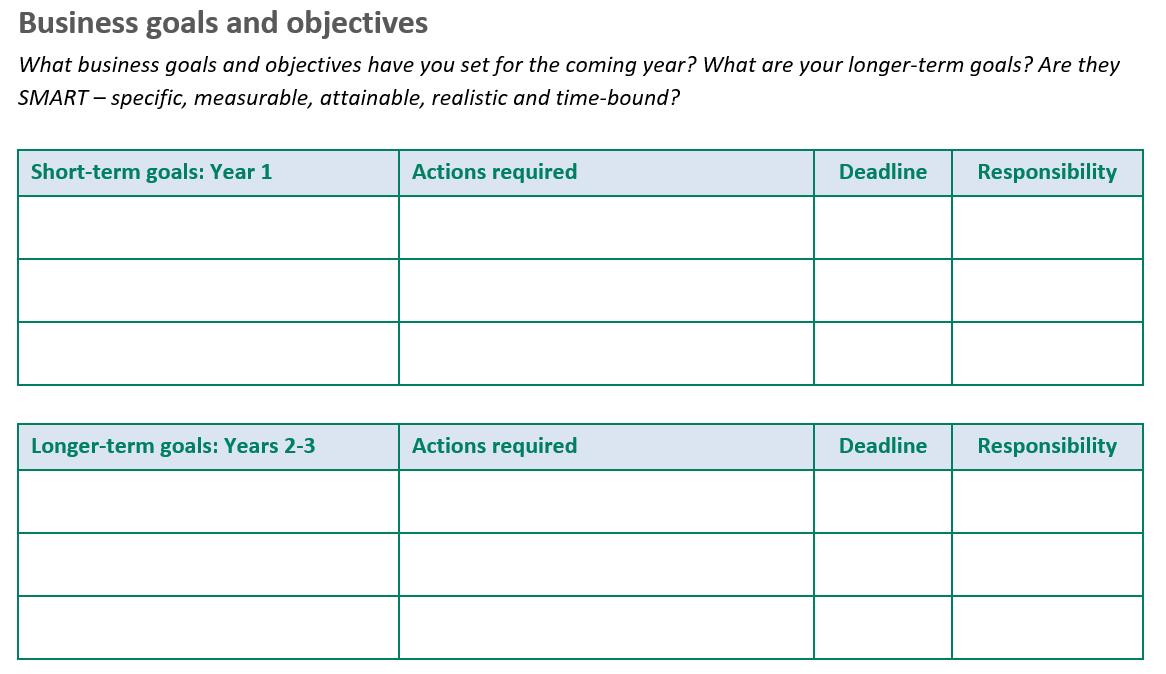

Step 1: Description of the business and its objectives

Coyness isn’t required here, and Olivia doesn’t hold back:

“Chocoholics Anonymous will be the most profitable plant-based chocolatier in the country and within three years will become the dominant plant-based chocolate brand.”

She explains how her business will be different from the rest. It will target three price points: budget, medium and high end.

Highlight how you developed your business idea and what you want to achieve

Most chocolatiers, she explains with examples from actual businesses, target only the medium and high-end. She wants to create a low-price revolution.

Similarly, describing her objective is unrestrained in its ambition.

She writes that she wants virtually all vegan chocolate consumers in the country to have heard about her business, and to have a one in 10 conversion rate among this audience – which is to say, 10% will have actively placed an order with her in the space of any year.

She bases these figures on the reach of major plant-based food manufacturers, thanks to taking a look at their annual reports, and creates a graph showing the sales increases she anticipates over the first, second and third years.

Use your business plan to highlight your goals and objectives

She lets her imagination run wild, and talks about wanting to scale the business to multiple retail outlets, and using a dedicated manufacturing base.

Investors need to see ambition because they’re investing in that future as well as the here and now.

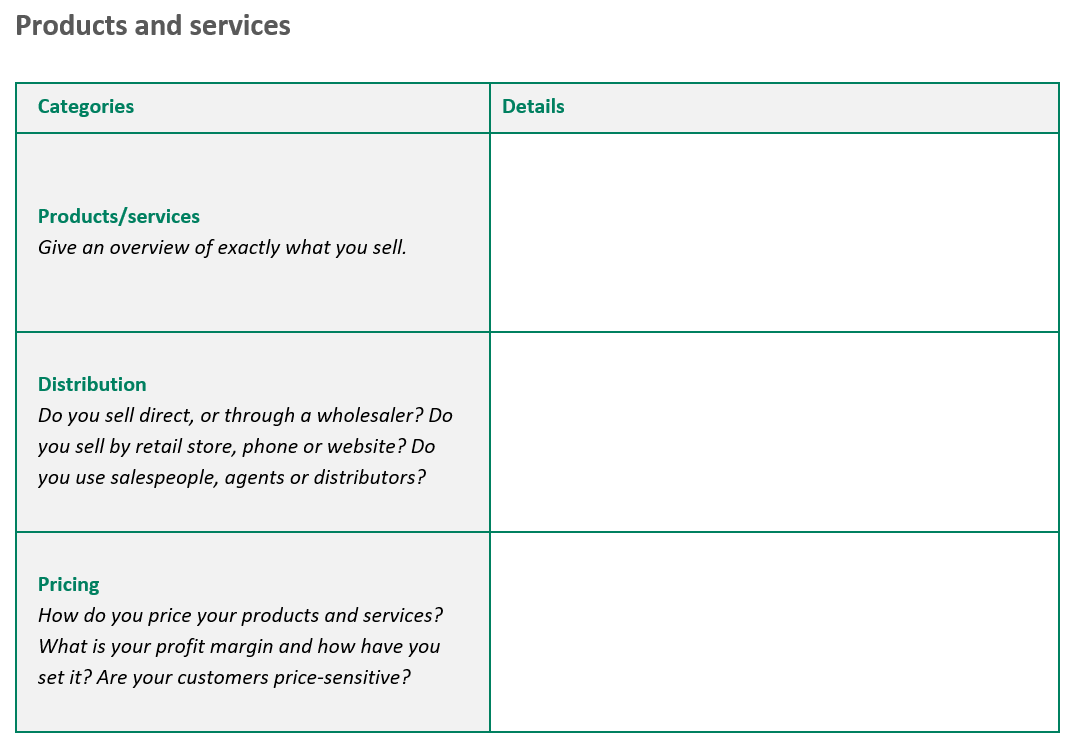

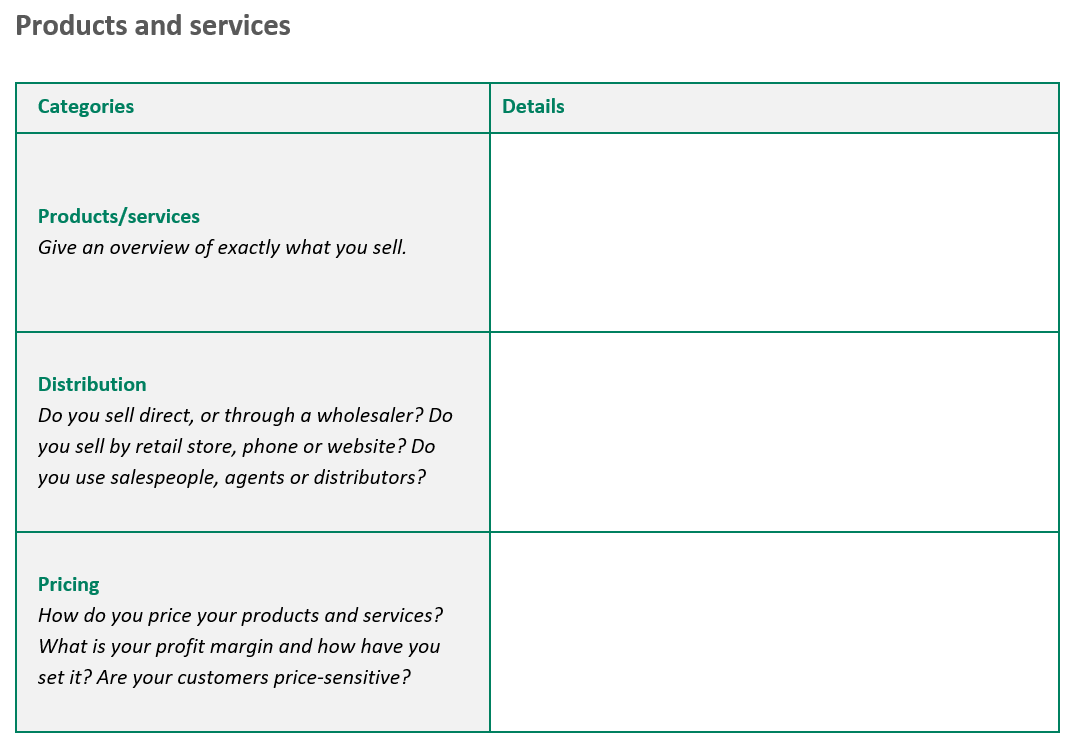

Step 2: Products and pricing

Olivia starts by breaking down her ingredient costs vs her profit margin, providing the figures in tables for ease of reading.

Then she explains her strategy for both creating and selling chocolate, and another unique selling point: she intends to offer discounts for bulk buying, so people will be encouraged to purchase more than one item each and every time.

She includes her product listing and provides examples of what she anticipates typical consumer purchases will look like, and how they will scale in this way.

Use this section of your business plan to go through what you’ll be selling

She also explains how she intends to operate both on and offline (or bricks and mortar, as it’s often called), and intends to run a loyalty-card scheme for her retail outlet.

Step 3: Customers

Olivia has done her research, which is the fundamentals upon which any business plan should be based.

People love statistics.

Olivia found statistics describing the growth in plant-based eating in the past decade, as well as the growth of flexitarian dietary choices.

Additionally, from those yearly reports from other plant-based food manufacturers and retailers, she’s able to take profiles of typical customers (personas), as well as discussions of their wants and needs.

And, of course, she finds their sales figures in their annual reports, so she can quote these as examples for her own potential reach, with a geographical breakdown for online sales.

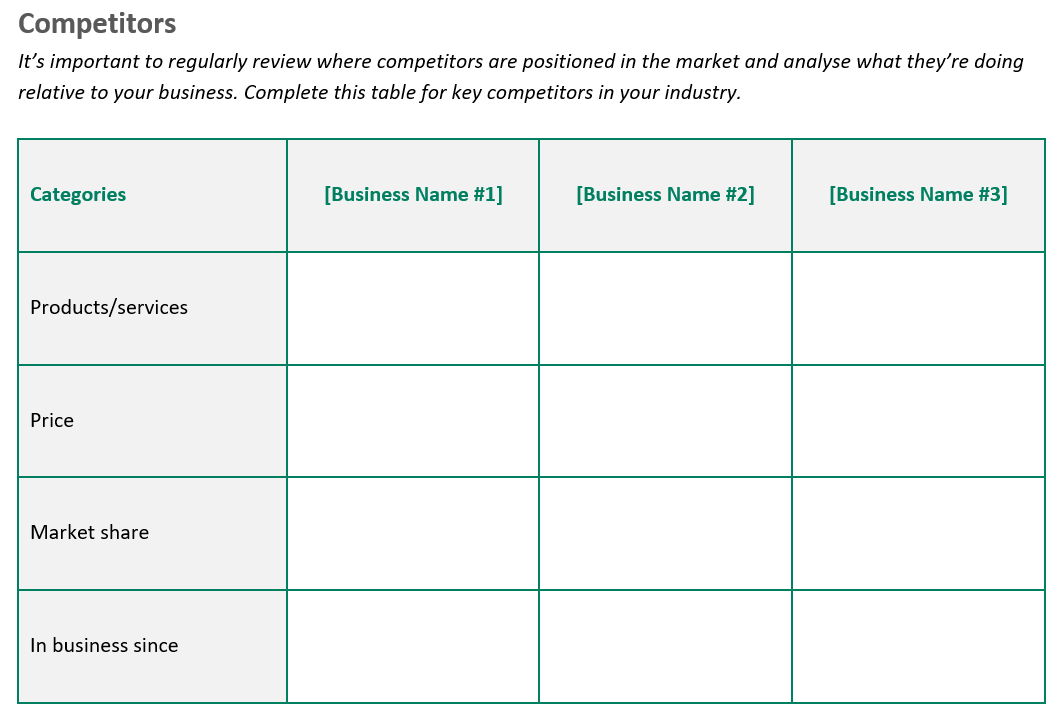

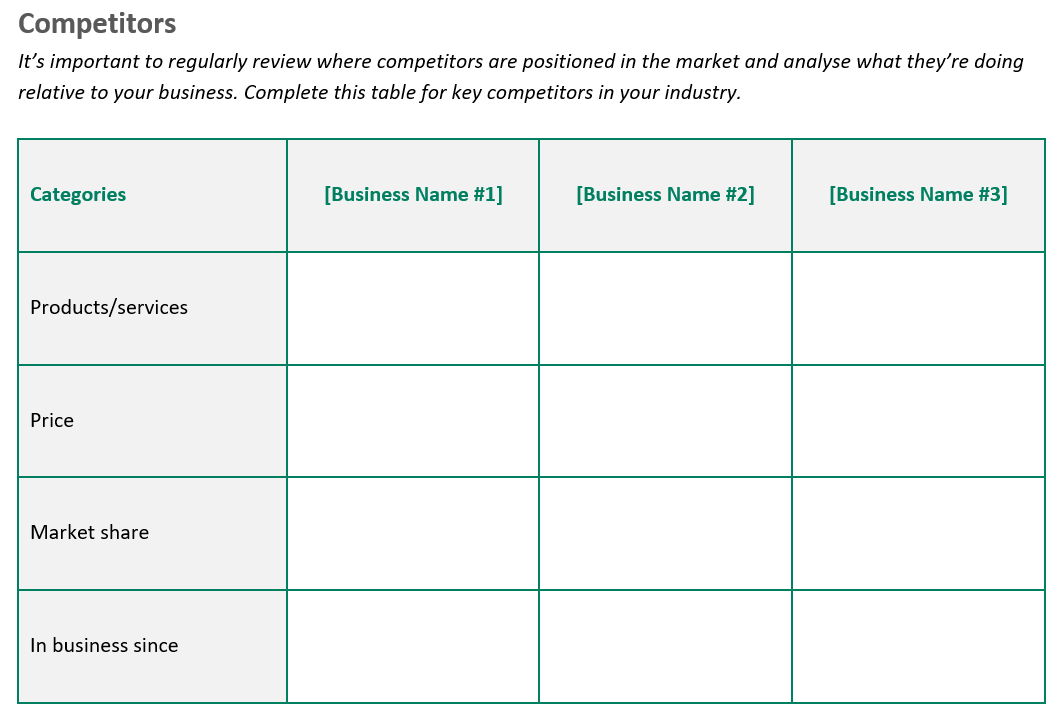

Step 4: Competitors

Although her initial instinct was to pretend that she had no competitors, Olivia doesn’t flinch in examining the competitive landscape.

She realises her investors will not be stupid and, thanks to Google, can do their own research in seconds.

Before handing over cash, any investor will do their own due diligence in any event to confirm what Olivia claims.

So, she provides details of online retailers worldwide, as well as bricks-and-mortar retailers local to her.

She includes any business that might compete in future, such as non-vegan retailers, or even restaurants and cafes who might sniff her success and provide products (although she also mentions how she hopes to supply these retailers).

Use this section of your business plan to highlight your competitor research

She highlights her own unique selling points by expressing them as weaknesses in her competitors.

This level of insight Olivia provides is good for several reasons.

Gaps in the market

It genuinely shows where there might be gaps in the market. For example, Olivia realises during her research that nobody is making products for baby showers with vegan chocolate. She spots a gap in the market for diabetic-friendly plant-based confectionery.

Competitor analysis

Competitor analysis is also good practice when she begins to run her business, because this kind of research will need to be ongoing.

She’ll always need to spot gaps in the market and aim to keep a step ahead of competitors.

Some competitors may simply clone what she’s doing, but because she started her work before them, she can exploit this competitive edge to keep innovating and remain one step ahead.

Being realistic

But mostly, by being so pragmatic Olivia is showing by her competitor analysis that she’s realistic about her prospects. This is something investors will respect.

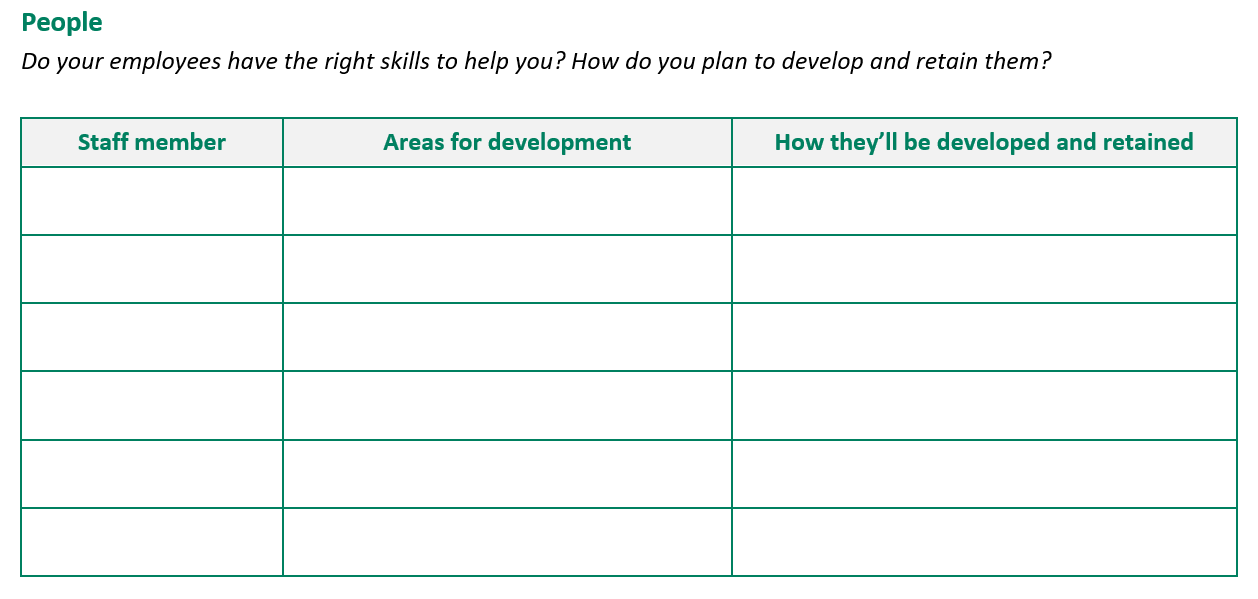

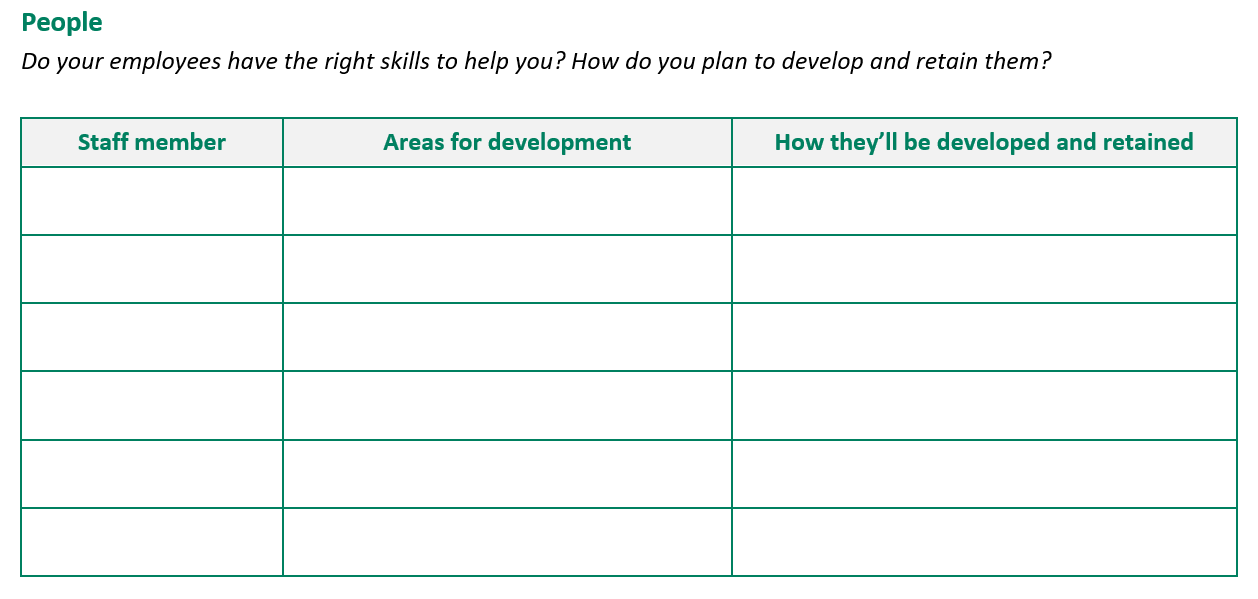

Step 5: Your people

Olivia starts by detailing her own qualifications and experience in retail, and her success up until that point operating the business from her kitchen.

She writes about her brother-in-law, who she intends to hire to man the store while she creates her masterpieces in the back. She details his qualifications and experience too.

Detail who will be working for you and the skills they’ll be developing

She highlights her expansion plans to take on new staff as the business goes on, and their roles – how she intends to use an online marketing manager when the business grows, for example, to expand her online reach.

Step 6: How to make the business a success

This is one question in the business plan where Olivia has a chance to be truly expansive while answering – although she knows to keep what she writes detailed and pragmatic.

She again discusses her plan to sell her products both online and offline.

Olivia mentions how she intends to exploit social networking to encourage online sales, and how she intends to run competitions with her products as prizes in order to build a mailing list.

She talks about her own experience of being vegan and how she’s firmly entrenched within the vegan community – both online and offline– and how she intends to use this to further the business aims, as well as how it gives her insight into sensitivities, and therefore marketing potential, among her community.

Olivia again does vital research and is able to show how her local area has a high proportion of people interested in plant-based eating, and who could become her bricks-and-mortar customers.

In short, anything and everything that could make her business a success is mentioned – and, in nearly every case, is backed up by data points.

Step 7: Profit and loss for the first three years

This is the toughest part of all.

Olivia has to work out all her costs moving forward – from day one of her business, all the way through to 36 months into the future when the business will hopefully look very different.

Having done her research, she knows her fixed costs – those that don’t change no matter how much she sells.

From speaking to estate agents, for example, she knows what a storefront rent is going to be.

From speaking to other business owners with stores via her local commerce association, she finds out what her bills are likely to be (water, electricity, internet etc).

She decides on salaries for herself and her brother-in-law.

Variable costs are harder for her to predict, because raw ingredient prices can be volatile. All she can do is list them at their current price, and adding a note about volatility.

Speaking to her potential suppliers, she asks the salesperson to give her a spread of recent prices so she can also show what the variation is likely to be. She factors in taking on casual staff as the business grows.

She projects how many units she will sell, and how this will grow.